Blog

How to define the value of your accounting firm

When you're busy running an accounting firm, there's not always time to step back and think about the journey you've been on. But it’s important to stop and take stock occasionally. Looking from the outside in, you have a chance to see how your client base has grown, how your team has expanded and how your in-house services have evolved to meet client needs.

Taking time out to review your evolution as a firm isn't just about sentimentality, though. This is a golden opportunity to review the underlying value of the firm, the quality of the practice and what the firm may be worth – both in financial, reputational and legacy terms.

So, where do you start when considering the value of your firm? And what are the important metrics to pay attention to when tracking your value over time?

What do we really mean by ‘value’?

Value. It’s a term that gets thrown around a lot in business circles, but it’s not always 100% clear what we mean when we talk about the value of a firm or business.

It can mean the financial value of the firm, of course, and what a prospective buyer might pay to acquire the business. But value can also be about the perceived worth of the firm for its many stakeholders. How much value does the firm hold for you, as a partner and owner? How do your clients perceive this value and the benefits that you bring to their company? And how do your team members gauge the perks and advantages of working for your firm?

The perceived value of the firm comes from a mix of all of these things. The potential sale value in the market. The brand reputation you have as a team of advisers. And how you’re seen as an employer, a professional services firm and an asset to the business community.

Knowing how your firm strategy can drive value

Understanding the value of the firm isn’t just about making a financial assessment of your assets and balance sheet. There’s also the prospect of how this value may drive your thinking as a partner group and your long-term goals for the firm and the partnership.

Understanding your short, medium and long-term goals for the practice is important, and will be tied in closely to the potential value that you and your fellow partners see from the firm:

For example:

- Are you looking to grow the firm in the medium term? – if your plan is to grow, it’s vital to focus on attracting and retaining new clients. This might mean investing in new technology to improve your client experience, expanding your service offerings or embracing different digital marketing channels. There’s also a need to develop and train your staff and to create a culture that attracts and retains top accounting talent.

- Are you looking to welcome new partners into the firm? – expanding the partnership means making the firm as attractive as possible to potential partners. Think about improving the firm's reputation, culture and financial performance, and develop a clear plan for how new partners would be integrated into the firm.

- Are you expecting to hand the firm to the next generation? – handing the firm to your children, or chosen successor, is about securing the long-term future of the firm and passing on your hard-won legacy. A strong succession plan will be essential, in tandem with a leadership training programme that develops a new generation of future leaders.

- Are you planning to sell the firm in the near future? – selling the firm will be reliant on potential buyers seeing the tangible and intangible value of the practice. This will be driven by your financial performance, marketability as a practice, and the quality and depth of your succession plan. It’s also vital to have a firm grip on the firm's finances and to have simple access to all the big numbers your potential buyer might want to see.

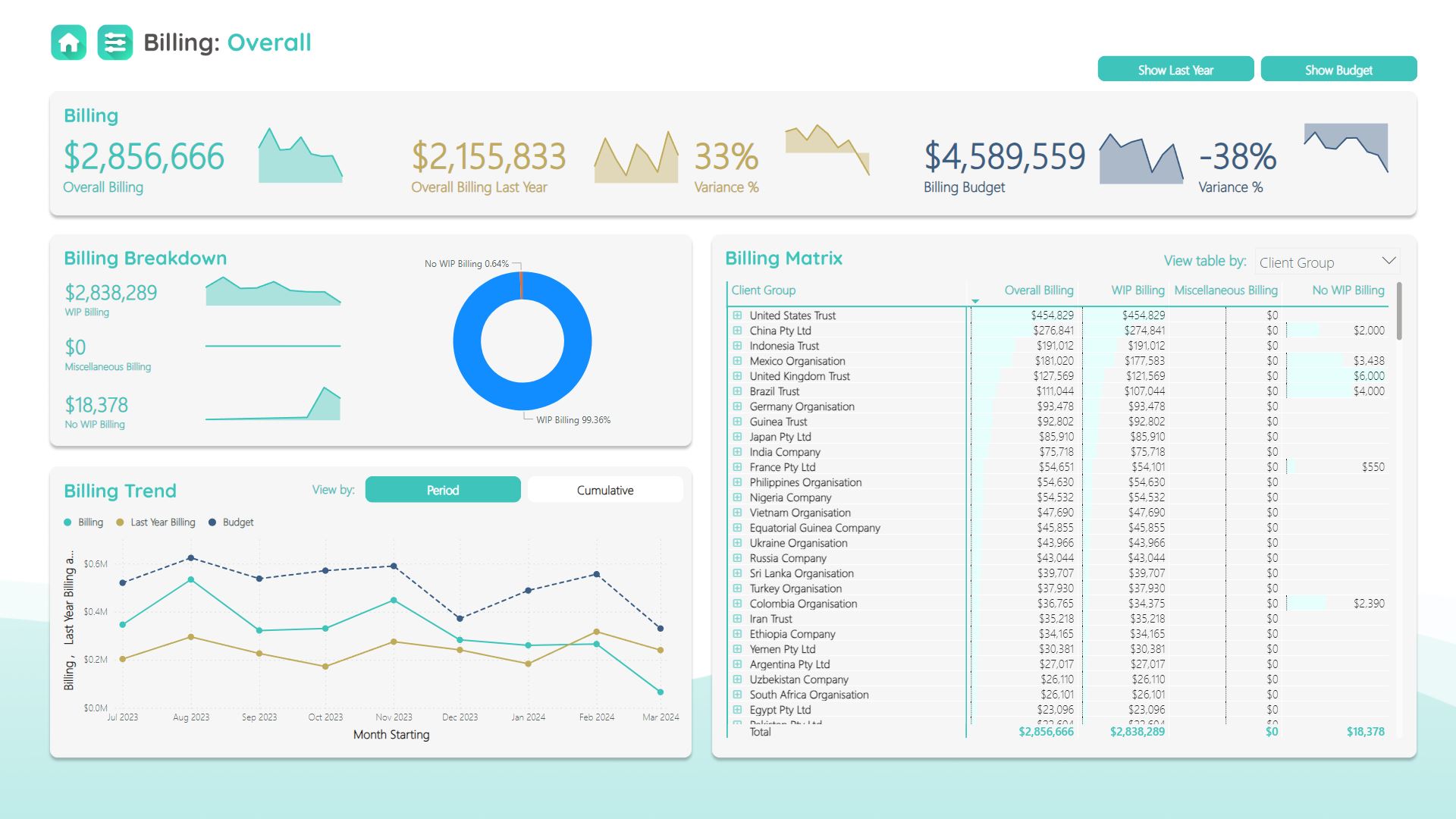

A real-time window into your firm’s metrics and KPIs

But which key performance indicators (KPIs) and firm metrics should you be tracking? And what do they tell you about the underlying fitness and value of the practice? The exact metrics that matter to your firm will be unique, but there are certain fundamental KPIs that every practice should be recording, reviewing and analysing on a regular basis.

We’ve highlighted five of the most important value-based metrics:

- Revenue growth – the firm’s revenue growth is a key indicator of the health of an accounting firm. As a partner group, you should be tracking revenue growth over time, looking for variances against your forecasted revenue goals, and benchmarking your revenue growth against industry standards and prevailing trends in the sector.

- Profitability – Profitability is another key indicator of your success and your profit-focused KPIs should be central to your reporting. Important metrics to keep an eye on will include your net profit margin and your operating profit margin as a firm.

- Client retention – it’s far cheaper to hang onto an existing client than to try and win a new client. Because of this, it’s essential to focus on client retention techniques and to track your retention score over time. Checking this metric on a regular basis helps you spot the client issues and get proactive about improving your client experience.

- New client acquisition – tracking how well the firm is attracting new clients is another good measure of the perception of the firm in the market. Check that you’re meeting your new client goals and also that you’re attracting clients from the most valuable, desirable or profitable industry sectors or business types.

- Staff turnover – if the firm is haemorrhaging talent, this is generally a bad sign. Your staff turnover is a good measure of your reputation as both an employer and a brand, so a high staff turnover rate can be a sign of problems within the firm. Track your staff turnover rates over time and look for the areas where improvements are needed.

By tracking and monitoring these key metrics, you;ll have a far clearer understanding of where the firm is doing well, where core improvements are needed and how the health of the practice is affecting your overall value and reputation as an accounting firm.

Dashboard Insights: shining a light on the metrics that matter

At Dashboard Insights, we know the importance of having detailed, real-time metrics at your fingertips. Our dashboards are designed to help your accounting firm get back in the KPI saddle, with tailored reporting that reveals the true value of your practice.

- Real-time insights – our cloud-based dashboards give you real-time insights into your firm's performance and health, with metrics that help you quickly track your progress, identify trends and patterns and make evidence-based business decisions.

- Customisable dashboards – we can easily tailor your custom dashboards, giving you the visibility you need to track the metrics and KPIs that are most important to the firm. It’s the simplest way to stay on track of your performance and value KPIs.

- Alerts and notifications – Dashboard Insights can be configured to send alerts and notifications to users when your key metrics and KPIs reach certain thresholds. This allows the firm to stay ahead of potential issues and quickly jump on the problem.

Dashboard Insights is the simple way to turbocharge your metrics and design a practical KPI dashboard for tracking your firm’s value.

Whether you’re looking to track profitability, new client sales or staff retention, you’ll always have the numbers you need to drive your success story.