Blog

Selling your accounting firm: 5 elements to include in your exit strategy

Putting your accounting firm on the market is a giant step for any partner. It will have taken you years, if not decades, to grow this practice and nurture it into the success story it is today. That's taken time, effort and a whole lot of dedication – so selling up and parting ways with your legacy can be a hard prospect to consider, both strategically and emotionally.

But with a clear exit strategy, and an awareness of the underlying value of your firm, you know you have a routemap for getting the best from the sale of your practice.

Here's our quick guide to selling up, with five critical elements to include in your exit strategy

1. Set clear goals and objectives for the sale

The first step in developing your exit strategy plan is to know WHY you’re selling up, and to set some clear goals and objectives for the sale. These goals will help guide your planning.

Sit down with your partner group and ask some important questions about the sale:

- What do you hope to achieve by selling your accounting firm?

- Do you want to maximise the value of the firm and your own end profit?

- Do you want to sell to a buyer who shares your values and will continue your legacy?

- Do you want to pass the firm onto the next generation, whether that be a family member or an internal firm successor?

- Are you looking to be bought out by a competitor or larger group?

There may not be an immediately clear answer to these questions, but it’s important that there’s agreement between the partners and a shared desire to sell up – either the whole firm, or just your own stake in the business as a partner.

Once you’ve agreed and decided on your goals and objectives, you can begin to develop a plan to achieve these end results.

2. Develop a timeline for selling up

A good exit strategy plan should include a timeline for achieving your goals and objectives. This will mean setting key milestones that tally with your goals for the sale, so there are agreed deadlines and a sense of impetus and motivation behind the sale of the firm.

Be realistic about these timelines and take into account factors such as the current market conditions, time needed for pre-sale housekeeping, and the time it may take to find a suitable buyer. It’s important to be flexible and to adjust the timeline as needed, but having timescales in place will help you to stay on track and make progress towards your goals

3. Identify potential buyers who fit the bill

Once you have a timeline in place, you can start the task of finding a suitable buyer for the firm. That might sound easy, but sourcing exactly the right buyer can be challenging.

If you’re passing on the firm to the next generation of your family, or have trained up a successor who is willing to buy you out, then finding that buyer is a lot easier. But if you’re putting the firm out on the open market, it may take more time to locate a buyer that meets your requirements – and is willing to offer a price that matches your objectives for the sale.

Here are some ways to widen the net and haul in your ideal buyer:

- Network with other accounting professionals and get word out in the industry

- Attend industry events where you can talk to a wider group of potential buyers

- Work with a business broker or M&A specialist, who can help you find interested buyers and secure a beneficial deal.

Purchasing your firm is an investment opportunity for the buyer, just like any other mergers and acquisition (M&A) activity. So, ensuring that the firm has good financial, sales and revenue potential will make it much easier to attract your ideal buyer.

4. Prepare the firm for sale (and increase the value)

The value of your firm can be divided into two areas: the tangible and the intangible. The tangible things are the assets in the firm and the price that a potential buyer is willing to pay for the practice. The price you can achieve will be dependent on the market, but it’s worth looking at industry benchmarking and recent sales to gauge a potential asking price.

But let’s not forget about the firm’s intangible assets. These are things like the satisfaction levels of your client base, the skills of your practice team and reputation of your brand in the market – all key drivers of whether the practice is seen as a good firm to buy out.

A core part of your exit strategy is to add value to the firm in the months, or years, preceding a sale. This means making the firm a viable and attractive business proposition, while doing everything in your power to add both tangible and intangible value to the firm.

This might mean:

- Getting your finances in order – ensuring the firm is in a positive cashflow position, with great revenue projections, will appeal to your buyer and allows them to see the potential for turning a profit and making money from this enterprise.

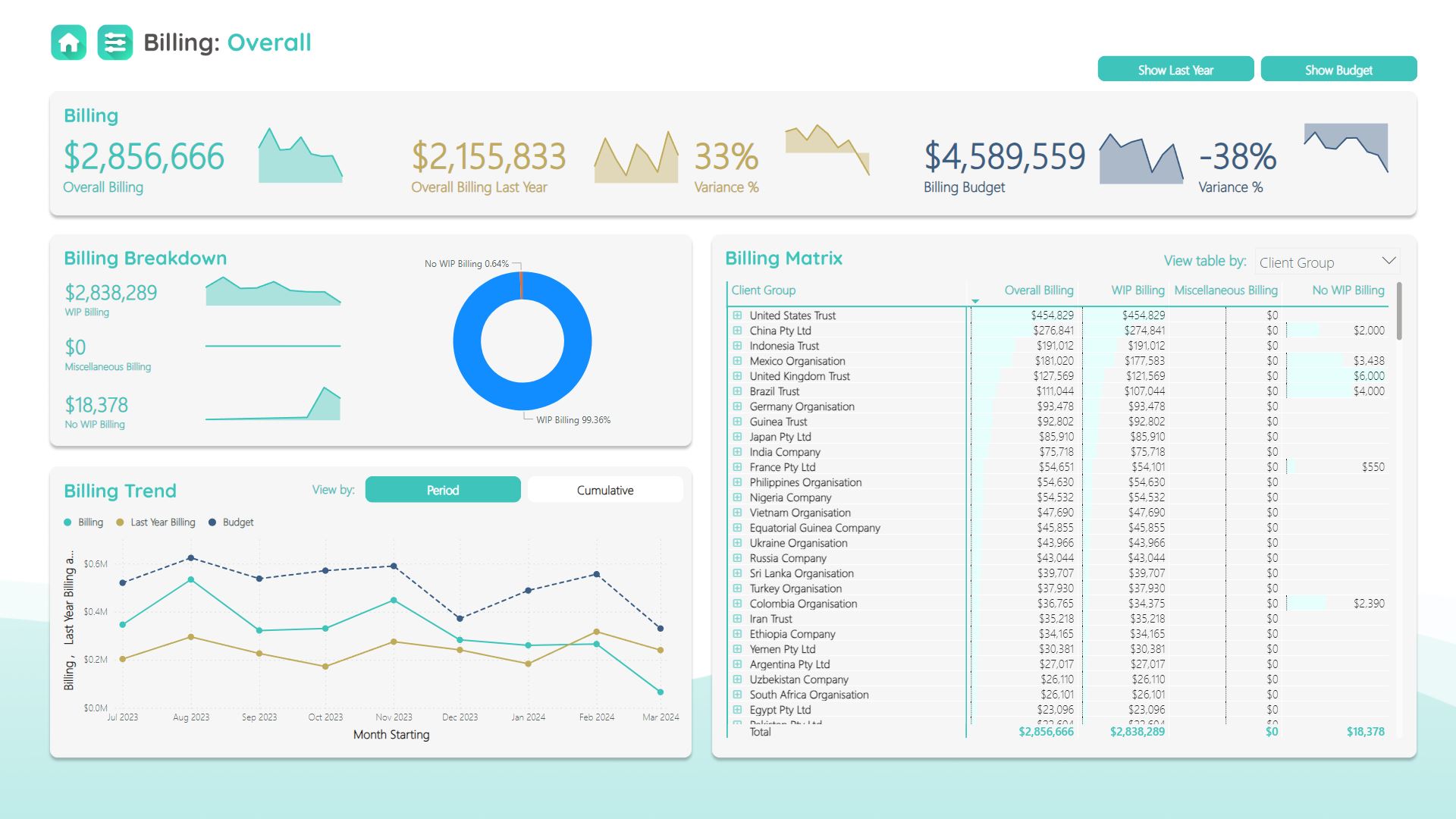

- Having the best data at your fingertips – buyers will want to see sales figures, profit margins and operational expenses before they dive into a sale. That means having an excellent reporting and dashboard system, with key metrics in place.

- Resolving any legal issues and snags – buyers don’t want to get caught up in legal wrangles and court cases. So, if you have any legal proceedings or HR issues in place, it’s best to try and bring these to a close before you attempt to sell.

- Retaining and attracting the very best talent – your staff are one of the most important assets you’ll be selling, so it’s vital that your practice team has the experience, abilities and soft skills to appeal to any prospective buyer.

- Streamlining your workflows and processes – a big intangible element is how well the firm works at an operational level. A firm using paper and desktop accounting is a far less attractive prospect than a cloud practice with automated workflows.

- Getting a succession plan in place – if your practice staff would be ported over in the sale, you’ll need to be clear about which roles are staying, who’s taking on the running of the firm and what the long-term strategy is for finding a new MD and leadership team.

It’s important to be transparent with your potential buyers, so you give them an honest and transparent view of the firm. The more you can do to provide numbers, metrics and evidence of the firm’s viability, the better your pitch will be when it comes to striking a deal.

5. Negotiate a deal that works for you and your buyer

Finding a buyer may take some time. But once you have an interested party, it’s time to get down to the serious business of negotiating the sale conditions, price and terms of the deal.

Negotiating the purchase price is an area where market knowledge and a sense of diplomacy will be very helpful. If you’re negotiating the sale through a broker or M&A specialist, they will be able to carry out some of the key negotiations on your behalf. But, even if you’ve sourced your own buyer, it’s sensible to work with a qualified adviser and legal team, so you cover all the right legal bases and have an airtight contract and price in place.

It will also be important to agree on a transition plan as part of your wider exit strategy, so there’s a clear handover of ownership, leadership and firm responsibilities.

Dashboard Insights: shining a light on the metrics that matter

The earlier you start your exit strategy planning, the more time you will have to add value to the firm and get the operational elements of the business reviewed, improved and updated.

At Dashboard Insights, we understand just how vital it is to have in-depth reporting and key metrics available to share with your prospective buyers. Our dashboards for accountants will track your financials, revenue, profitability and cashflow – in fact, all the key financial numbers your buyer will want to review during the negotiation process.

Using our dashboards, you’ll be able to share:

- Real-time insights into the financial and non-financial health of the firm, so prospective buyers can gauge the viability of the business.

- Customisable dashboards that can record, track and reveal all the important key performance indicators that you should be tracking while adding value to the firm.

- Alerts and notifications that tell you when your key metrics and KPIs reach certain thresholds, so you and your buyer can be transparent about performance and targets.

Dashboard Insights for accountants is the simple way to turbocharge your metrics and design a practical KPI dashboard for tracking your firm’s value.

If you’re aiming to sell your accounting firm in the near future, Dashboard Insights helps you track the big metrics that measure the value and viability of your accounting business.