Blog

How to Decrease WIP Days and Bill Quicker with Dashboard Insights

Effective work-in-progress (WIP) management is not just a fundamental practice for accounting firms—it's critical to financial stability and client contentment. High WIP days, indicating pending work and uninvoiced services, can significantly impact cash flow and overall profitability.

In this blog, we will delve into actionable strategies to reduce WIP days from 48 to 24, facilitating faster billing and elevating operational efficiency.

Understanding the Challenge

Before we delve into the solutions, it's crucial to comprehend the potential consequences that can arise from high WIP days. Work-in-progress encompasses billable time and services not yet invoiced to clients. Therefore, elevated WIP days can directly impact cash flow and profitability.

Reducing WIP days isn't just about financial benefits—it's about creating an environment where your accounting practice can flourish. By addressing this challenge effectively, you set the stage for improved productivity and quicker, more efficient operations.

Strategies to Reduce WIP Days and Expedite Billing

1. Streamlining Workflow and Task Prioritisation

Establishing a structured workflow is the cornerstone for streamlining your operations. Analysing and optimising your processes can help eliminate potential bottlenecks and redundant steps.

Clear Task Priorities: Ensure urgent and high-value tasks are promptly addressed. By prioritising these tasks, you can expedite their completion and billing.

Organised Workflow: A clearly stepped-out workflow ensures smoother task progression and reduces unnecessary delays. A roadmap of tasks and their dependencies, can minimise idle time and keep the workflow steady.

2. Emphasising Effective Communication and Collaboration

Efficient communication plays a vital role to reduce WIP days. Cultivating an environment where team members can openly communicate project statuses, challenges, and deadlines establishes avenues for updates and collaborative problem-solving.

By promoting a culture of effective communication, you enable your team to work cohesively towards common goals. When everyone is on the same page, tasks are completed more efficiently, and billing can happen promptly upon task completion.

3. Leveraging Technology and Automation

In today's tech-centric age, powerful solutions are available to minimise WIP days and expedite billing.

Modern Accounting Software Implementation: Automating repetitive tasks and providing real-time insights into project statuses can significantly reduce WIP days. By automating routine tasks, your team can focus on high-value activities, ultimately fast tracking billing processes.

Integration of Project Management and Accounting Systems: Aligning project management tools with accounting systems ensures accuracy and accelerates invoicing. Seamless integration allows for a direct flow of project data into the invoicing process, reducing manual effort and potential errors.

Taking control of the automation process lifts administrative burdens, enhancing the accuracy and efficiency of the billing process.

4. Continuous Process Review and Improvement

No company can thrive without regular process reviews, as they are an integral component in the identification of areas of improvement.

Soliciting Feedback: Actively seek feedback from team members and clients to offer diverse perspectives on your firm's operations. This feedback can reveal inefficiencies or areas where streamlining is needed.

Data Analysis: Analysing the data and feedback provided by team members allows for the refinement of strategies. By identifying patterns or recurring issues, you can tailor your approach to mitigate these challenges effectively.

When you establish a work culture that prioritises continuous refinement, you enable your firm’s processes to remain efficient and effective over time.

Incorporating Dashboard Insights for Expedited Processes

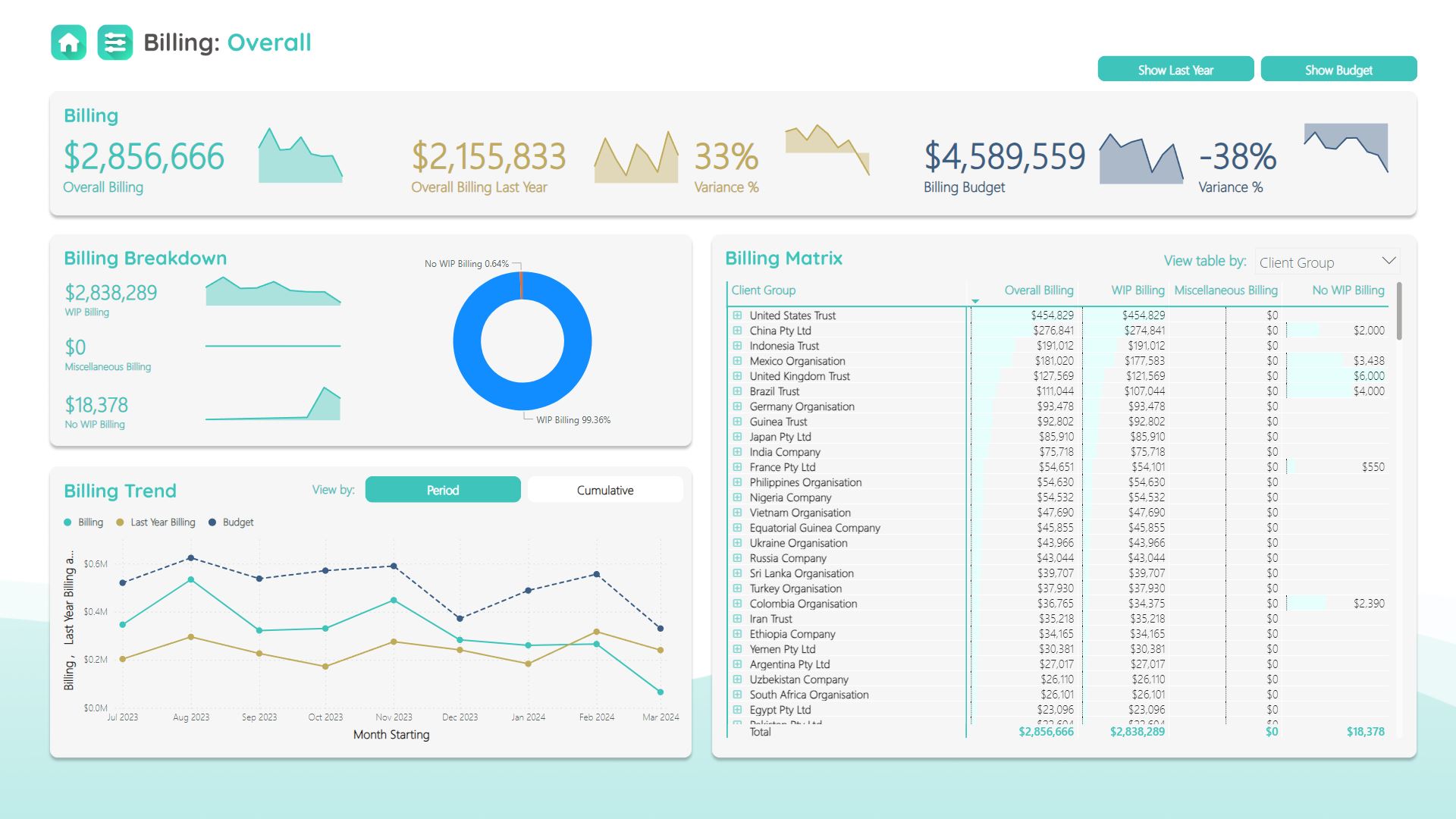

An invaluable tool in this endeavour is leveraging Dashboard Insights. This sophisticated platform offers real-time data visualisation, enabling quick identification of project statuses, resource allocation, and potential bottlenecks.

Full workflow view: Dashboard Insights do this by transforming client, invoice, cost, job, task, employee, time sheet, and budget data into a meaningful set of insights which surfaces the right information, to the right people, at the right time. Dashboard Insights helps firm owners understand what’s going on in their firm and gives them peace of mind that they are focusing on solving the right problems.

Real-time Decision-making: With instantaneous insights provided by Dashboard Insights, informed decisions can be made promptly, making workflow faster and reducing WIP days. Real-time data ensures that the team is always aware of the project's status and progress.

A new approach

Harnessing technology and fostering a culture of agility and efficiency will assist to position your firm for long-term success. It can help strike a balance between productivity and client satisfaction.

With the aid of Dashboard Insights, this journey becomes even more streamlined and efficient, paving the way for a successful and prosperous accounting practice.

By taking a proactive approach and embracing innovation, your firm can navigate the intricacies of billing and WIP management effectively. Here's to a future of optimised operations, satisfied clients, and a thriving accounting practice!