Blog

Metrics that Matter: How each KPI of your Accounting Firm affects your Profitability

Profitability in the accounting industry isn't simply about revenue earned. It's directly influenced by a handful of key performance indicators (KPIs). These KPIs, although appearing as just numerical data, offer valuable insights into the financial and operational health of your firm.

In this blog, we'll dive into four crucial KPIs - Productivity, Work-in-Progress (WIP), Billing, and Recoverability. We'll understand their significance, impacts, and how these KPIs will drive profitability and operational efficiency in your accounting firm.

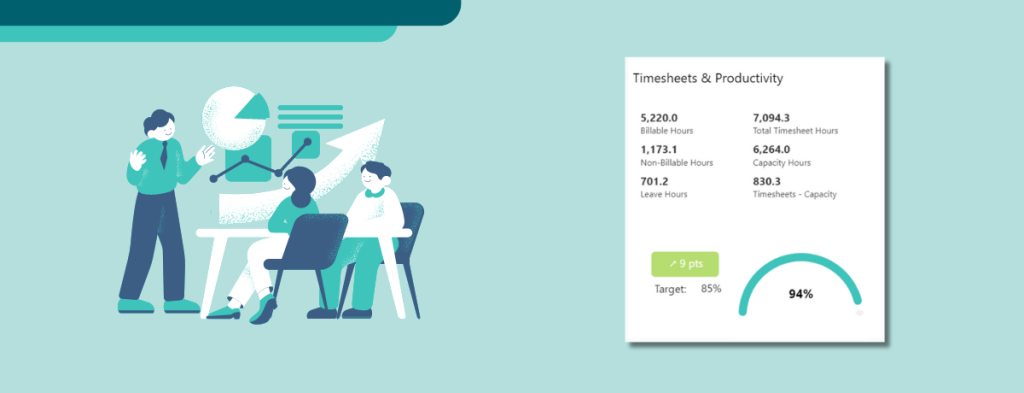

Unlocking the Potential of Productivity

When we talk about productivity, what comes to mind? It's often linked to the amount of work we can get done within a set amount of time. However, in an accounting and bookkeping firm, productivity isn't just about ticking tasks off a to-do list. It's also about the amount of work that can be directly billed to a client. As productivity increases, the billable work that can be billed to the client also increases.

To illustrate, XPM measures productivity as the ratio of billable hours (the time we spend doing client-related work that we can bill) to total hours worked (which includes both billable and non-billable hours). Imagine you have a team that works eight hours a day, but only three of those hours are billable. It means that for more than half of the time (5 hours), the team is doing non-billable work - perhaps administrative tasks or internal meetings. This would reflect a low productivity score. While some non-billable work is always necessary, a high volume of it could indicate inefficiencies in the way a team is working.

Tracking and analysing productivity help identify inefficiencies, enabling you to allocate resources better and maximise billable hours. This lies in assessing what non-billable tasks are taking up most of the time and figuring out how to reduce them. This usually involves a variety of solutions, such as automating administrative tasks or refining internal processes to reduce meeting times.

By successfully identifying and reducing these inefficiencies, we can increase the amount of time available for billable work, increase the amount billed to the client, and eventually increase profitability.

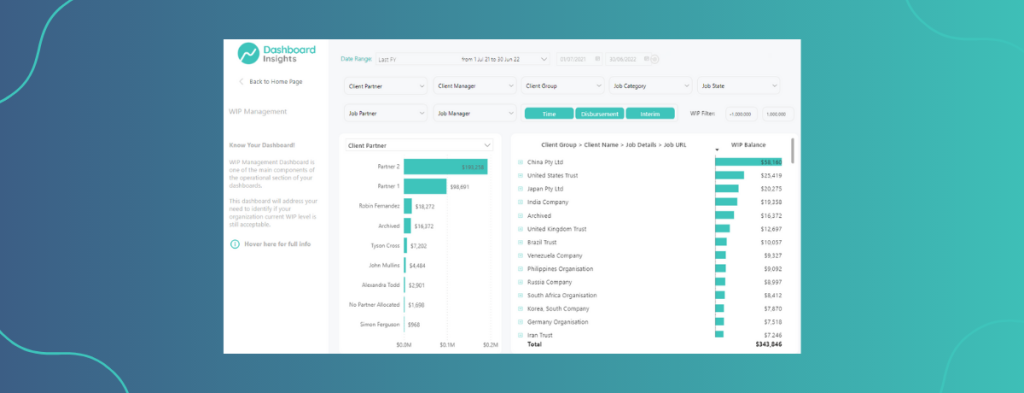

Managing Work-in-Progress (WIP) Efficiently

Work in Progress (WIP) is an important KPI for firms as this refers to the work that's already started but not yet billed to clients. WIP Balance increases when team members clock in billable hours or incur job costs and decreases when you invoice clients or clear jobs from the invoice list. This is why a high WIP balance isn't necessarily good news - it could suggest inefficiency, indicating there's plenty of work produced but it's not being turned into invoices quick enough.

The goal in any business, particularly in the accounting industry, is converting as much work as possible into billable revenue in a timely manner. Doing this not only improves your cash flow but also minimises the risk of overlooking any WIP and consequently having to write it off.

So, the question is, how do we manage WIP efficiently? We need to ensure that our WIP balance is not too high and not too low, and moves smoothly from ongoing work to invoiced and, finally, paid work.

Ensure full visibility on WIP to help team members see where they might be falling behind and for them to gain insights on what can be improved on. This helps identify potential bottlenecks that could be slowing down the invoicing process, and it points out areas where you can boost efficiency.

In a nutshell, mastering WIP management is all about streamlining the process and leveraging tools to optimise it. Managing it is an efficient way to increase your firm's profitability and ensure that your team's hard work translates into tangible financial results.

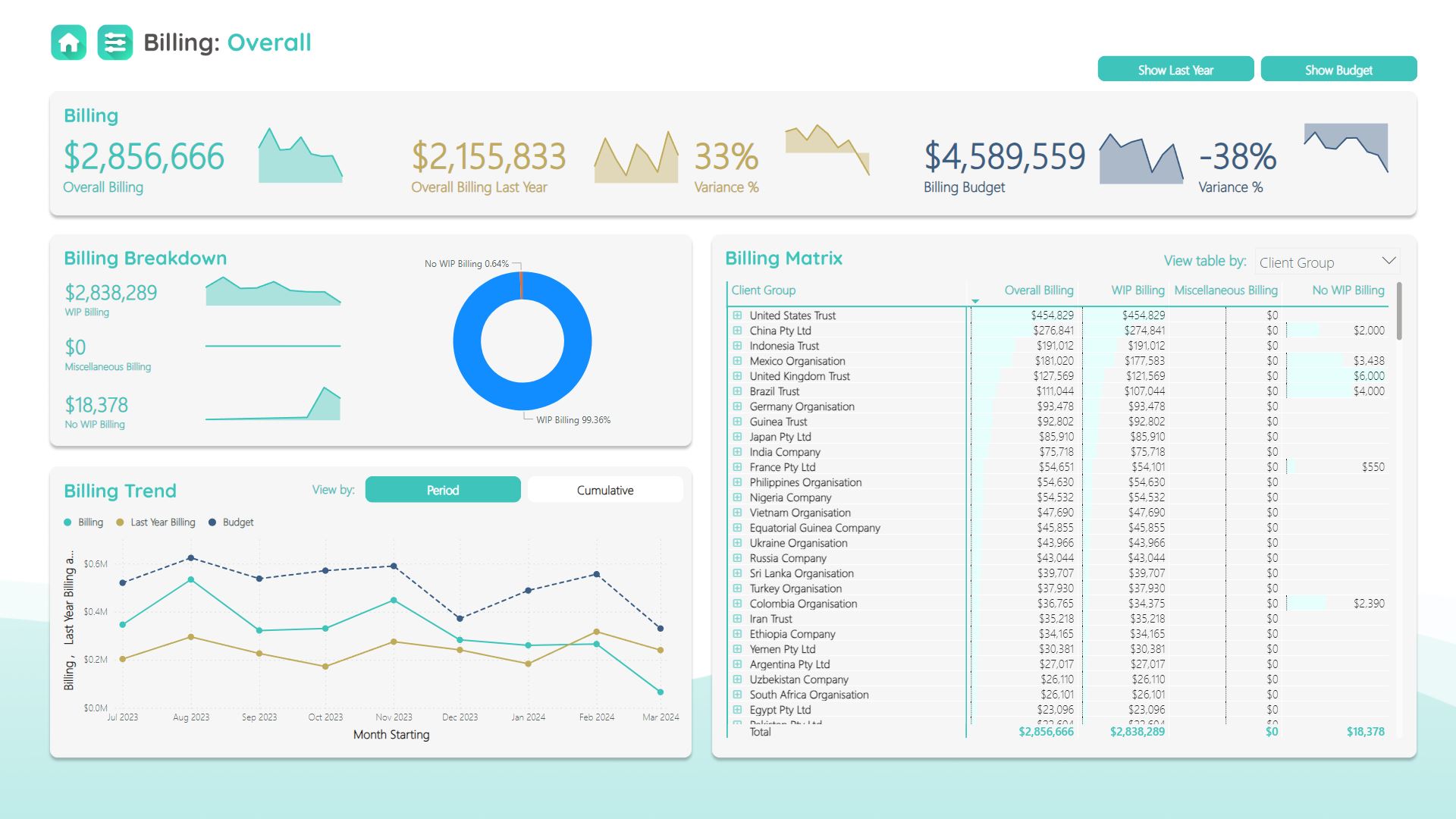

Driving Revenue with Effective Billing

Billing transforms the team's hard work (WIP) into income. However, the focus isn't just on the total billed but on the breakdown—identifying who is generating revenue and from what work type.

Consider this scenario: a team member who's highly efficient in tax advisory tasks consistently contributes to a significant part of the firm's income. Such insight can be instrumental in directing resources and work allocation strategically.

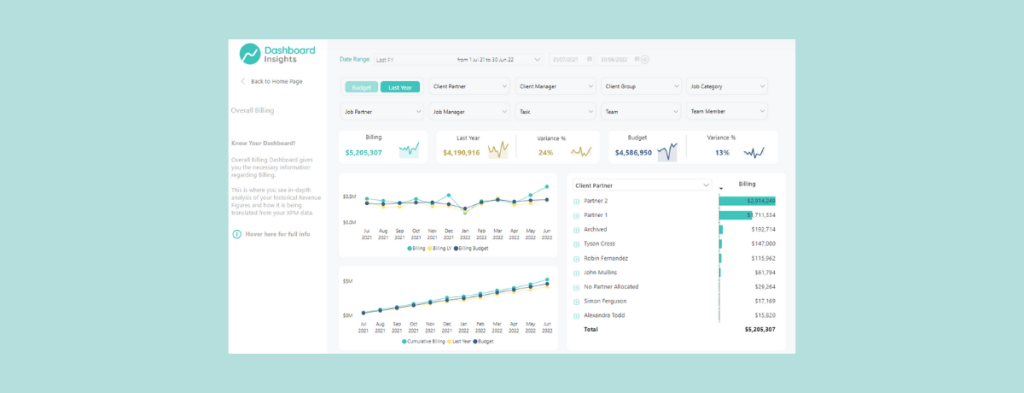

What will help is to have an accurate and clear overview of your billing patterns, showcasing who and what jobs bring in the most revenue to gain actionable insights to enhance your firm's performance.

To summarise, efficient billing will greatly impact profitability. By understanding and managing billing patterns, you’re not only improving your cash flow, but also making data-driven decisions that can push your business towards greater success.

Optimising Profit with Recoverability

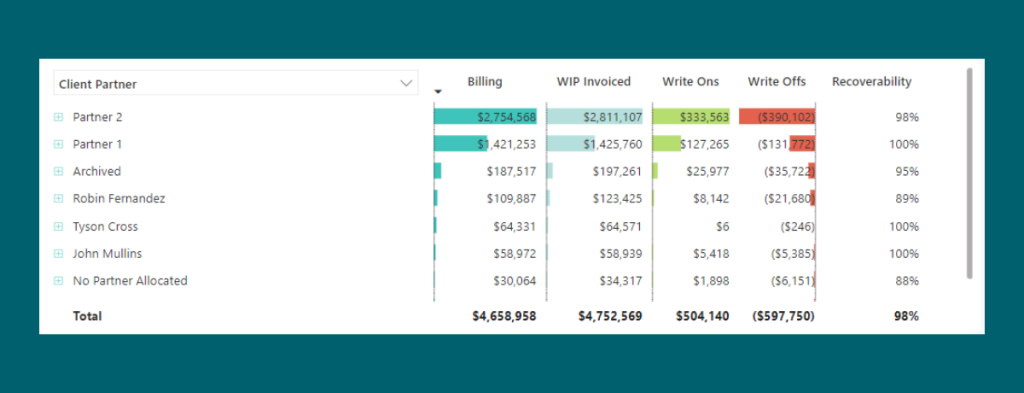

Recoverability measures the proportion of the WIP that is successfully billed to clients. Low recoverability may signal that too much work is being written off or that billing rates are not reflective of the work value.

For instance, you may find that a team member is spending a lot of time on a complex task for a client, reflecting a high WIP balance, but the quality of work does not seem to reflect that and you have decided to write-off some amount. In such cases, you might need to reassess your pricing structure, task allocation, or billing rates to ensure they are reflective of the work value your firm brings to clients.

Monitoring recoverability regularly will provide insights into your billing processes, helping spot patterns and inefficiencies in your business. Ultimately, a higher recoverability rate means higher profitability, and that's a goal worth striving for.

Profitability as a Continuous Journey

Profitability isn’t a single destination but a continuous journey, guided by your firm’s KPIs. It's about fine-tuning your operations, leveraging insights, and making data-driven decisions to optimise running your firm more efficiently based on real-time data. Using data analytics solutions such as Dashboard Insights will enable you to boost your firm's performance by putting the right information in the hands of the right people, at the right time.

At Dashboard Insights, we're here to assist you in navigating and supercharging these metrics. With a deeper understanding of Productivity, WIP, Billing, and Recoverability, you can chart a more profitable course for your accounting and bookkeeping firm.