Blog

How to avoid cracking the WIP to drive performance

Keeping on top of your accounting firm’s Work in Progress (WIP) is vital for tracking your practice team’s performance, staying on top of utilisation and making sure you’re billing out to clients in the most effective way. But good WIP management is also a critical factor in keeping your engagements profitable and ensuring the firm’s cashflow in a positive position.

How do you manage to drive this performance without cracking the whip (or should that be WIP?) and coming across as the classic micro-manager?

Unlocking the secrets to effective WIP management in accounting firms was the central focus of our recent webinar, hosted by Trent McLaren from Journey and featuring Ryan Richardson, our Dashboard Insights founder and managing partner at TNM Consulting.

Let’s explore the evolution of WIP management and discover how Dashboard Insights can transform the way you and your accounting firm approach WIP management.

The evolution of WIP management

Traditionally, WIP in accounting firms has been a top-down management process. For things to work well, the responsibility fell on the partner or the engagement leader to pull together the right WIP information, to analyse that data and to then disseminate this to their team.

But, as Ryan pointed out during our recent webinar, this top-down approach is a highly ineffective way of getting on top of your firm’s WIP.

“So if you think about my role five years ago, it was very much about top-down management of our WIP. I would have to go and get a whole lot of information, pull it out of our practice management solution, and then start to collect the information in some sort of a way that was digestible for our team.”

“Firstly, the reality is that this took me a lot of time. But, secondly, I then had to disseminate that information, which involved a lot of time inefficiency.”

This inefficiency and lack of easily accessible WIP information was one of the key drivers for Ryan to build Dashboard Insights.

With practice information centralised and delivered through our various dashboard templates, the firm could quickly get on top of WIP. And by removing Ryan as the ‘bottleneck’ in the management process really served to empower his team.

“Managing our WIP is now efficient and transparent. Everyone has access to the right information at the right time, rather than just when I've decided to collate it. Realistically, that's assisted our team to really take control of their WIP.

So, I no longer have this situation where I've got this top-down management responsibility for managing WIP. The reality is that our WIP control process is driven from our team members up.”

And that ease of access to WIP information has transformed the WIP management process. It’s now a team-empowered process, rather than a top-down management chore.

Understanding WIP and its impact for the firm

Ensuring that your team is tracking well on engagement work and is supplying all the right deliverables on schedule is a big part of the management process on a job. But your WIP management also has a significant impact on the firm’s current cashflow position and your profitability on the engagement. If work is left unbilled for too long, there’s a danger of tipping the firm into negative cashflow and damaging the financial health of the business.

In a professional services firm – whether that’s an accountancy firm, or a law firm – WIP can be broken down into three basic areas:

- Timesheet-related WIP

- Disbursements

- Interims

And, as Ryan explained in our webinar, understanding these three elements of WIP is very important when you’re aiming to keep the firm on a solid financial path:

“When we come back to WIP, there are three main components. First off, there’s timesheet-related WIP, so timesheets multiplied by an hourly rate to provide a timesheet value of WIP. Or, in other words, WIP that’s made up of unbilled time.”

“The second component is disbursements, so, for example, incurring a subscription or a legal fee on behalf of a customer or whatever it may be. So, disbursements on your WIP are costs incurred by the practice that are not yet billed to a customer.”

“And then the third component is the concept of interims, which is essentially deposits or recurring billing amounts that are not yet washed up or connected to a particular timesheet.”

In short, if these three components of the firm’s WIP are well controlled, you'll be converting your productive hours into billing sooner, rather than later. That helps you drive cashflow and profitability of the business.

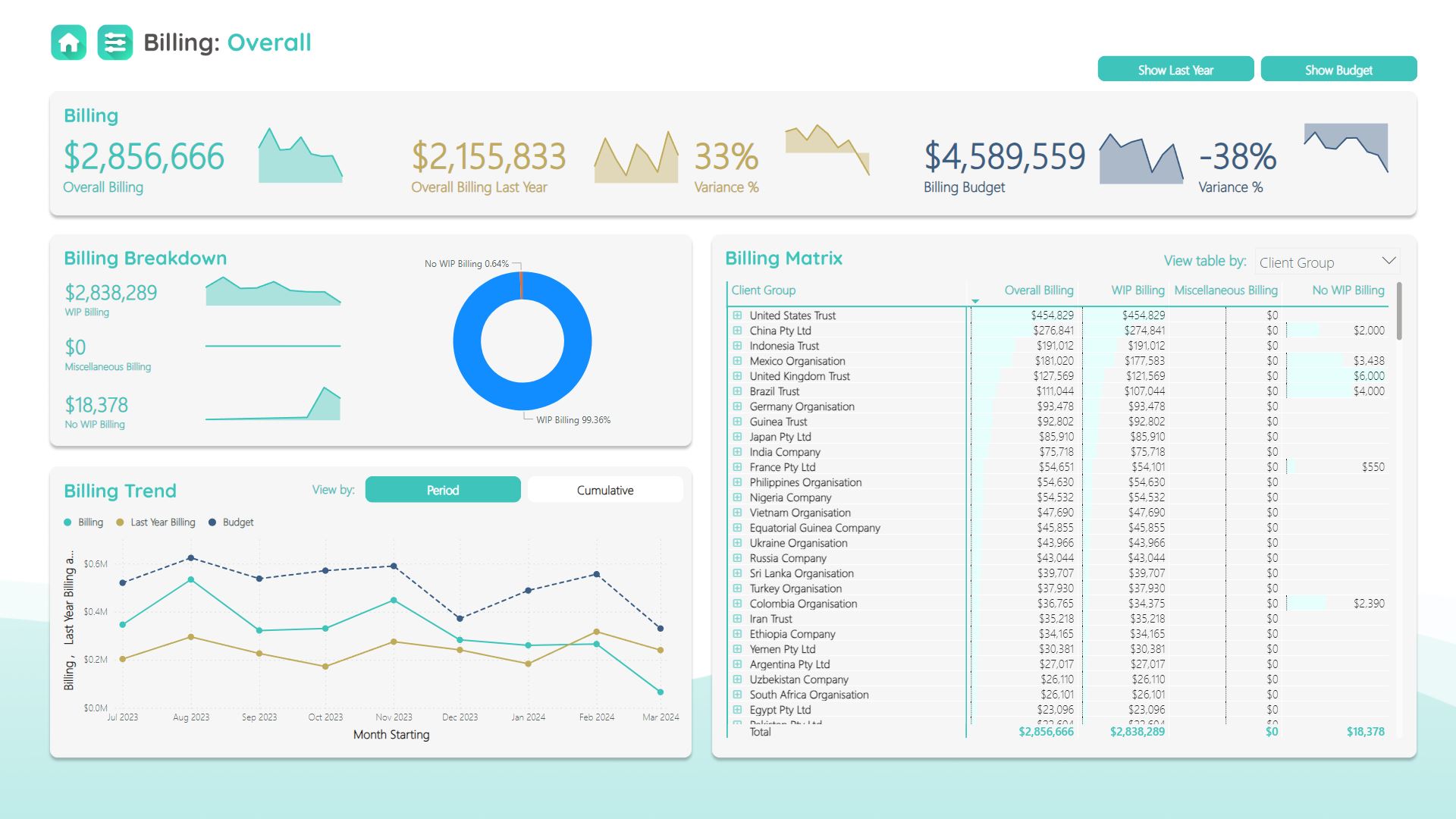

Dashboard Insights as the key overview of your firm’s WIP

So, managing your WIP efficiently isn’t just a performance thing. It’s a vital part of helping the firm stay in a liquid cashflow position and bringing in meaningful profits. But to drive the team-empowered approach we mentioned, you need deep, accessible insights into your WIP.

Dashboard Insights is a powerful tool for getting a clear overview of your WIP data. But it’s also an incredibly useful tool for addressing the main pain points associated with WIP management.

The big pain points when managing your WIP come down to:

- Poor profitability and poor cash flow – the number of practices that struggle with cashflow and profitability can be surprising. The answer, at base level, is to maintain the firm’s revenue and to have that productive hours-to-billing conversion going on.

- The ageing of WIP – the longer WIP stays on the shelf and remains unbilled, the less recoverable it is. So, actively and effectively managing your WIP means that you've got more recoverable work to bill out to the client – and that’s great for your cashflow.

- Individual responsibility for WIP – every individual in the firm needs to play their role in managing WIP. It’s this collective responsibility for keeping WIP under control and billing out effectively that drives the fundamental financial health of the business.

These pain points are pretty much universal, whatever the size of your firm. But when you have the right WIP, billing, cashflow and revenue metrics in front of you, it’s far easier for the whole team to get proactive with their WIP management.

Dashboard Insights offers a multi-faceted approach to your WIP management. At the individual level, your team members can now track the most important WIP-based key performance indicators (KPIs), focusing their efforts on productivity, billing, recoverability, and WIP.

In a nutshell, this is what Dashboard Insights does: as an operational tool, it shows you the WIP numbers you need to see and puts you back in control.

As Ryan explains, developing Dashboard Insights and plugging it into his firm’s WIP process has been transformative for TNM Consulting:

“Five years ago, it was really the responsibility of too few people in our organisation to manage WIP. Now it's everyone's responsibility, and the organisation is empowered, appropriately and realistically. We've almost halved our WIP days over a period of time without changing our billing structure. Over three and a half years of managing WIP with Dashboard Insights, we’ve nearly halved our WIP days.”

That’s a stat you can’t really argue with, and shows just how important Dashboard Insights has become in keeping TNM Consulting on top of their WIP management game.

Dashboard Insights: don’t crack the whip, collaborate on your WIP

Mastering your WIP management is a crucial element in making your accounting firm a financial success story. What emerged from our webinar was that Dashboard Insights is a game-changing tool when your firm’s WIP is starting to get out of control

Don’t rely on the traditional, top-down approach of putting responsibility for WIP with a senior partner. Instead, integrate Dashboard Insights into your practice tech stack and give the whole practice team access to their WIP KPIs and performance metrics.

If you’d rather collaborate on your WIP and leave the whip at home, Dashboard Insights is the reporting and KPI tool you need at the heart of your WIP process.