Running an accounting firm today requires delivering quality service and staying competitive by finding new ways to improve and grow.

But in order to do that, it’s essential to understand how your firm is performing—and how it stacks up against others in the industry.

The Dashboard Insights FY24 Benchmarking Report provides a detailed comparison across firms of all sizes, highlighting real numbers from over 170 Australian Accounting Firms to provide valuable insights into the firms’ performance, strategies, and goals.

By understanding your firm’s position in the market, you can guide your strategic decisions, from improving efficiency to exploring new service lines.

See how your firm stacks up against others:

The Dashboard Insights Benchmarking Report is designed to help you understand your firm’s performance and uncover new growth opportunities. Here’s how you can leverage these insights for growth:

Identify Areas for Improvement

To enhance all areas of your firm, it’s essential to optimise internal operations. By focusing on managing and improving key metrics such as WIP, Productivity, and Recoverability, you can unlock efficiencies that will positively impact every aspect of your business.

Improving operations lays the groundwork for better client service, streamlined workflows, and consistent revenue growth. When your firm runs more smoothly, the benefits extend across the board—from staff productivity to client satisfaction.

Maximise Profitability Through Strategic Adjustments

WIP management can be a bottleneck for many firms. Longer WIP days mean delayed cash flow and reduced efficiency. By streamlining processes and adopting better job and billing management practices, you can turn things around.

Strategising to shorten WIP days not only accelerates cash flow but also improves your firm's operations and efficiency.

Refine Your Pricing Strategy

The industry is staying competitive, and if you haven’t reviewed your pricing and fee structures recently, now is the time.

Firms that diversify their service offerings and adopt flexible billing models, such as retainers, often achieve greater revenue stability. By aligning your pricing strategy with current industry trends and maximising the visibility of key metrics for service offerings and pricing, you can enhance your firm's adaptability and better position it for long-term success.

Make Data-Driven Staffing Decisions

The Australian accounting industry faces ongoing challenges with talent shortages and recruitment. Insights from the Benchmarking Report reveal minimal headcount growth across firms.

While some firms excel in productivity, they can be hit with limitations in scaling, and firms with larger teams may struggle to maintain efficiency with complex team structures. Having visibility and control over data highlights the importance of making informed team management decisions—whether through targeted hiring, team development, or admin process automation—to drive sustainable growth and maintain competitiveness in the current market.

Plan for Sustainable Growth

The report points out key growth drivers for the coming year, such as client acquisition, service expansion, strategic pricing, and technology adoption. Align your firm's goals with these trends to stay ahead of the curve.

Whether you're looking to grow your client base or introduce new services, having a data-driven strategy will help ensure long-term success.

Conclusion: Tailored Strategies for Every Firm Size

The Dashboard Insights FY24 Benchmarking Report highlights the challenges and opportunities for Australian accounting firms, segmented by firm size. By leveraging the data and insights in the report, your firm can identify areas for improvement, measure performance against industry peers, and uncover opportunities for growth. This report not only provides a roadmap for refining your firm’s strategies but also helps you make more confident, informed decisions to stay competitive in the market. We’re confident it is a valuable tool for any firm looking to align its operations with industry best practices and drive long-term success.

Ready to see how your firm stacks up against the competition?

What is Dashboard Insights?

Dashboard Insights offers data analytics solutions designed to help the accounting and professional services industry streamline operations, track key metrics, and uncover growth opportunities. Our tailored dashboards are designed to empower teams and drive business success by delivering the right information, to the right people, at the right time.

Curious to see how it works?

Book a demo today and discover how Dashboard Insights can help your firm stay ahead of the competition.

October 2024 – Dashboard Insights, a leader in providing data analytics solutions that empower accounting firms to make informed business decisions, proudly welcomes Michelle McKenzie as their new Sales and Customer Success Executive.

As a Certified Chartered Accountant, Michelle brings over 24 years of accounting experience, driven by her passion for helping small businesses, accountants and their clients succeed. With 8 years of experience as a Senior Account Manager at Xero, she played a critical role in supporting accounting firms across Australia in adopting and optimising practice management solutions and driving strategic client relationships. Michelle is also an expert in business restructuring and recovery and has helped many businesses streamline and automate processes through technology. Her appointment comes as Dashboard Insights continues to expand its impact across the industry.

Ryan Richardson, Founder of Dashboard Insights, shared his excitement: "Having Michelle join us is a major win for our team. Her extensive experience as a Senior Account Manager at Xero and her deep knowledge of accounting and practice management solutions like XPM perfectly aligns with our focus at Dashboard Insights. With Michelle’s leadership, we’re confident in strengthening our commitment to accounting firms, helping them leverage data to drive business performance and operational efficiency."

Michelle McKenzie is equally enthusiastic about the opportunity: "I’m thrilled to join a forward-thinking company like Dashboard Insights, particularly after their recognition as Xero Practice App of the Year FY24 in Australia. I’m eager to bring my experience to the table and help our clients navigate the evolving landscape of accounting technology, enabling them to drive efficiencies and boost profitability through data-driven decisions."

This appointment highlights Dashboard Insights' commitment to enhancing client experience and ensuring firms have the tools they need to succeed. With Michelle at the helm of sales and customer success, Dashboard Insights is set to further its reach and continue delivering innovative solutions to businesses.

For more information about Dashboard Insights, please visit our website.

About Dashboard Insights

Dashboard Insights is a leader in data analytics solutions, making data-driven decisions easier than ever for accounting and professional services businesses. The platform enhances key metrics like productivity, profitability, and recoverability, coupled with streamlined operations for increased efficiency and reduced costs. It empowers staff with real-time performance insights, driving continuous improvement and ensuring the right information is with the right people, at the right time.

Getting Started

Welcome to Dashboard Insights!

We’re excited to have you explore the Dashboard Insights WFM Dashboards.

Whether you're diving in for the first time or looking for a quick refresh, this guide is designed to walk you through every step of setting up and using your dashboards effectively.

Here, we’ll share insights, tips, and tricks to ensure you get the most out of your WFM Dashboards experience.

In this guide, we’ll cover:

- Step 1: Exploring the Dashboard Insights Homepage

- Step 2: Navigating dashboard reports and utilizing filters

- Step 3: Updating your profile settings

- Step 4: Accessing support

Let's get started!

Step 1: Explore the Dashboard Insights Homepage

If you're new to Dashboard Insights, you're in the right place.

Let’s start with a quick overview to get you familiar with the layout.

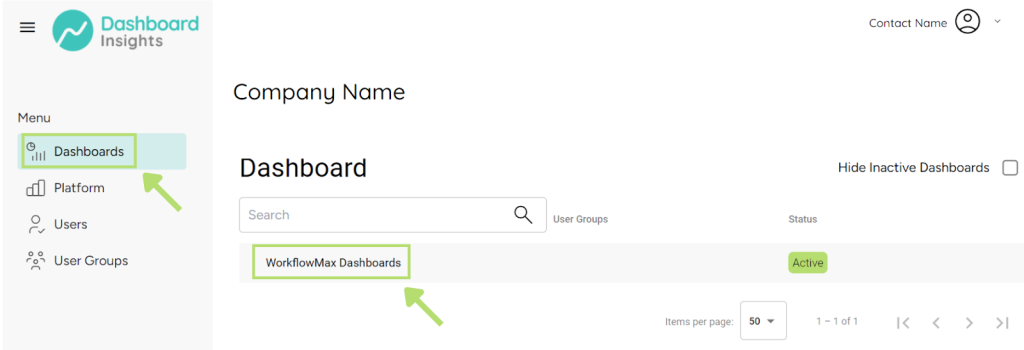

Access your dashboards

Navigate to the “Dashboards” tab after logging in.

On the Dashboard page, click the “WorkflowMax Dashboards”

This is your dashboards center, where all your WFM data comes to life.

Here, you'll find a comprehensive overview of your different dashboards, providing visibility to Billing, Job, WIP, and more!

Head over this link to navigate your dashboard reports and filters.

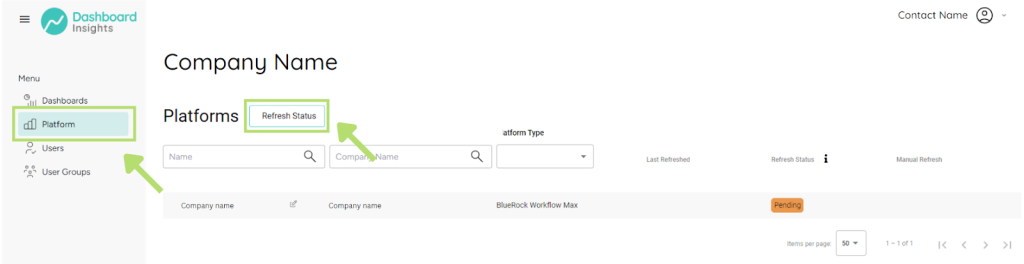

View your platforms

To view your platforms, click on the “Platforms” tab.

To ensure your platform list is up-to-date, click “Refresh Status”.

This ensures any changes or updates are reflected accurately on your dashboard.

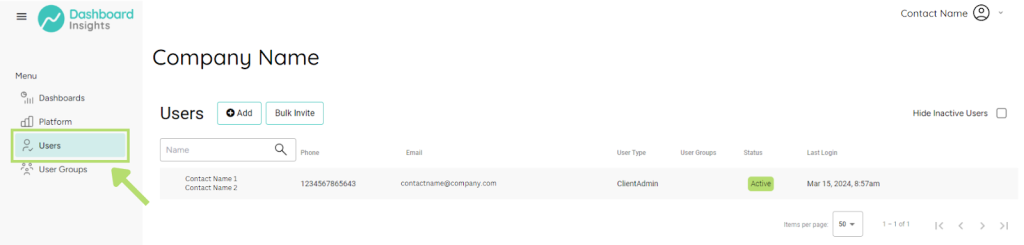

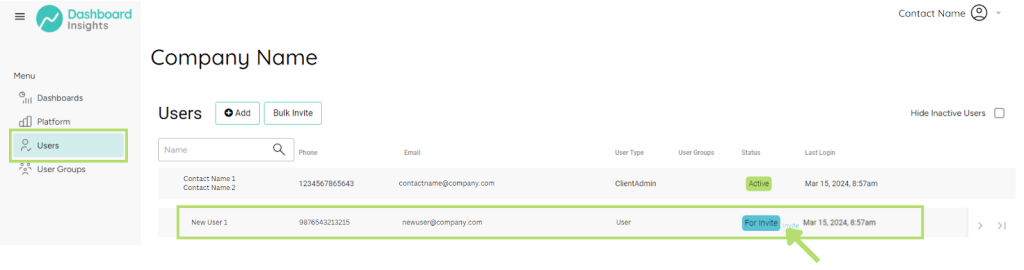

View and add users

For user management, head over to the “Users” tab.

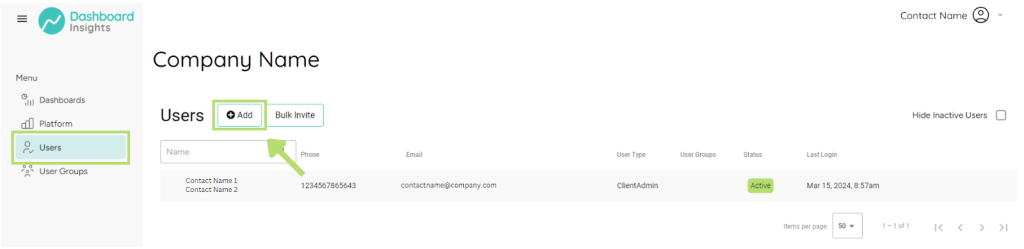

You can add new users individually or in bulk.

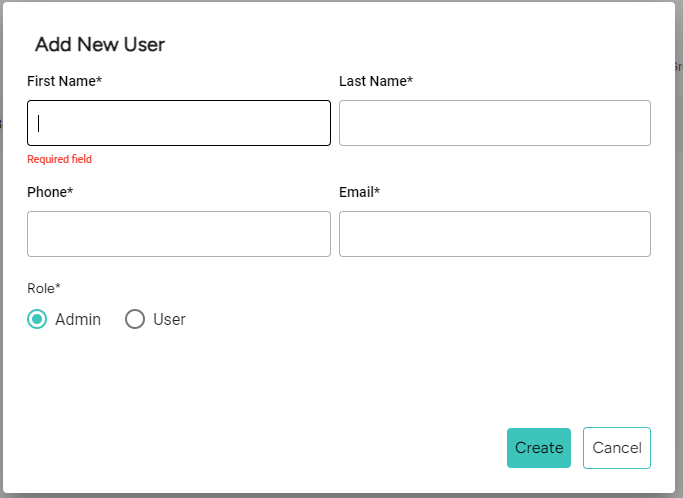

To do this, simply click the “Add” button.

Enter the user’s first name, last name, phone number, email, and role to grant access for the dashboards.

This ensures that the right people have the right access to the relevant dashboards.

Click “Create”.

New user will be visible in the user list.

Click “Invite” to trigger Dashboard Insights registration instructions to new user via email.

Users who successfully registered will show as “Active”.

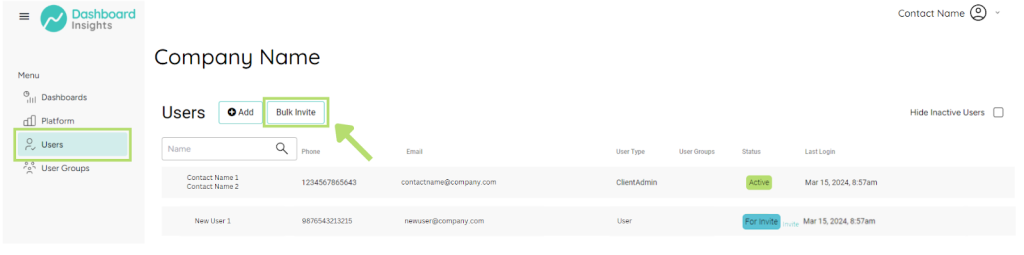

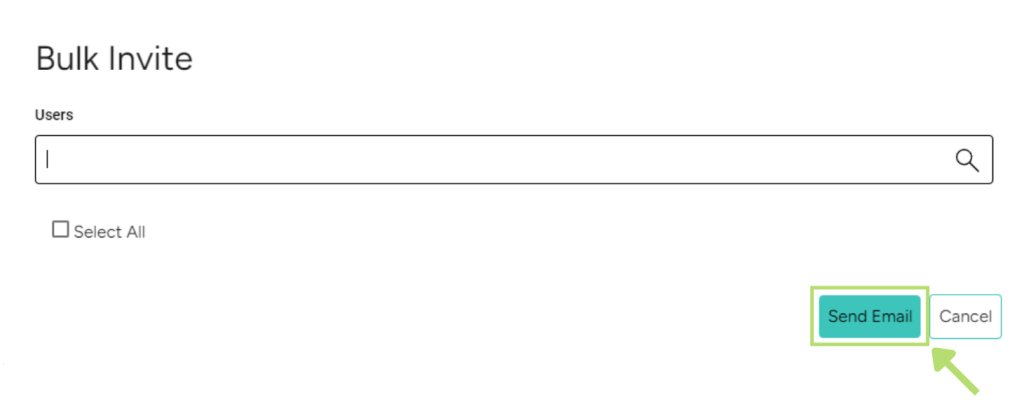

To invite new users in Bulk, click “Bulk Invite” and select the multiple users you want to send registration instructions to via email.

Click “Send Email” to trigger bulk invites.

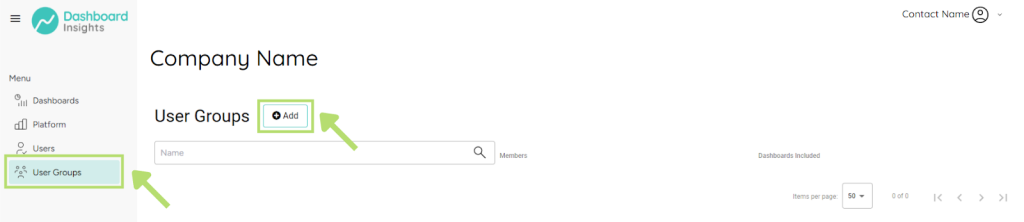

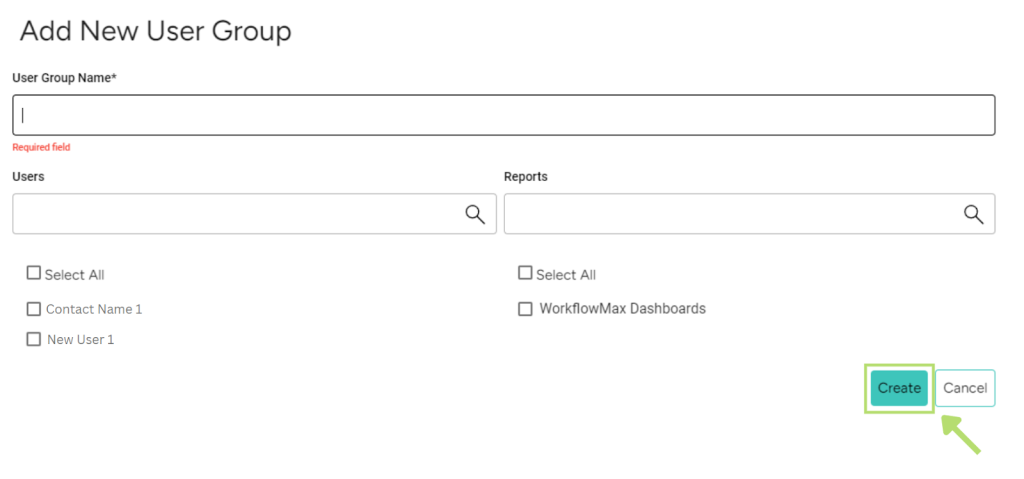

View and add user groups

In the “User Groups” tab, you can organize users into groups.

This is especially useful for limiting access to certain dashboards based on user roles, enhancing both security and efficiency.

To add a User Group, click “Add”.

Input a Group Name for this User Group.

Tick the checkboxes of the users included in the group.

Tick the checkboxes for the Dashboards that the selected users will have access to.

Click Create.

Step 2: Navigate Dashboard Reports and Filters

Now, let’s dive into the dashboard reports.

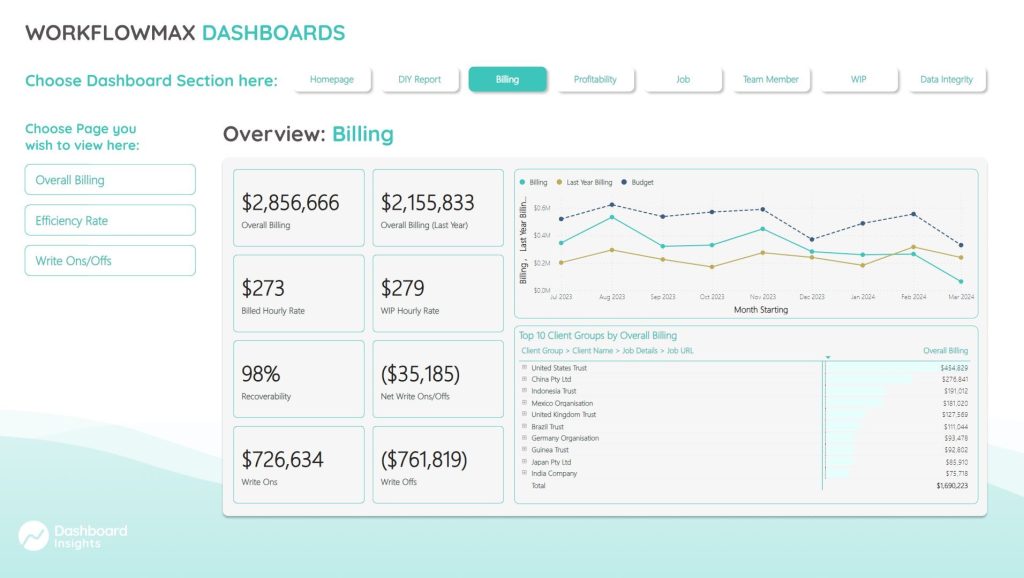

Each report offers visibility of metrics and data-driven insights into various aspects of your business operations and management:

- Billing

- Profitability

- Job

- Team Member

- WIP

- Data Integrity

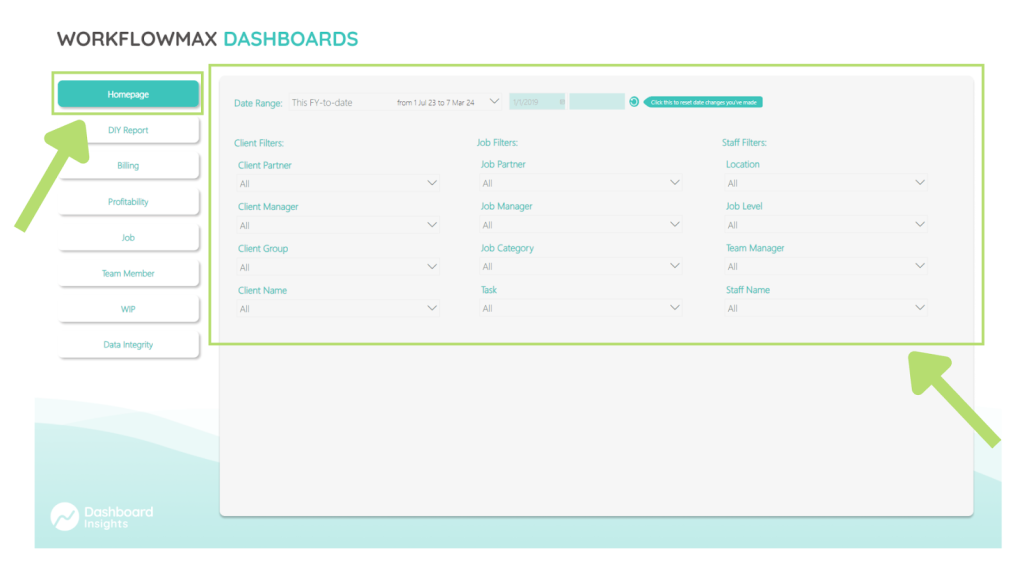

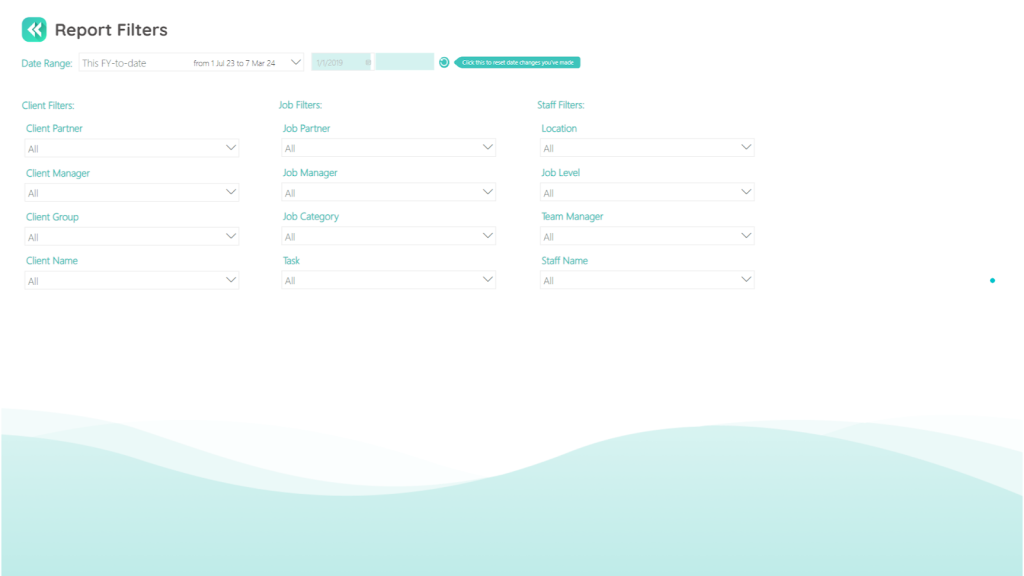

Utilize filters

To get started, navigate to the homepage of the reports section.

In this section, you can set your preferred filters for the reports you want to see.

You can filter by date range, client details, job specifics, and staff attributes.

This allows for precise tailoring of information based on the criteria most relevant to your needs.

For instance, to filter by client, select options like Client Partner, Client Manager, Client Group, or Client Name.

Similarly, job and staff filters can be adjusted to refine your data further.

Maximize the Report Filters to your advantage by drilling down on the specific attributes you want to reflect on your dashboards.

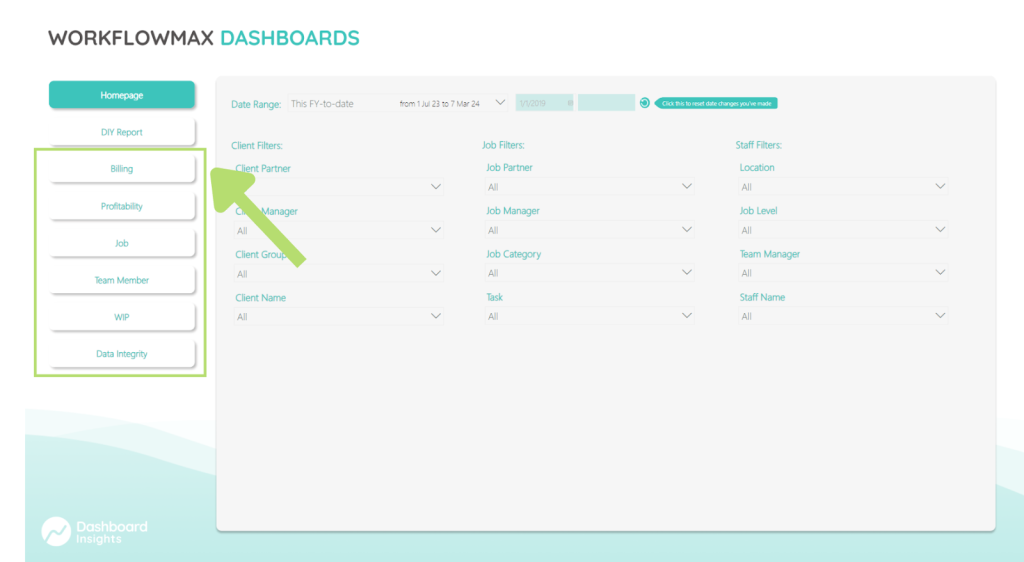

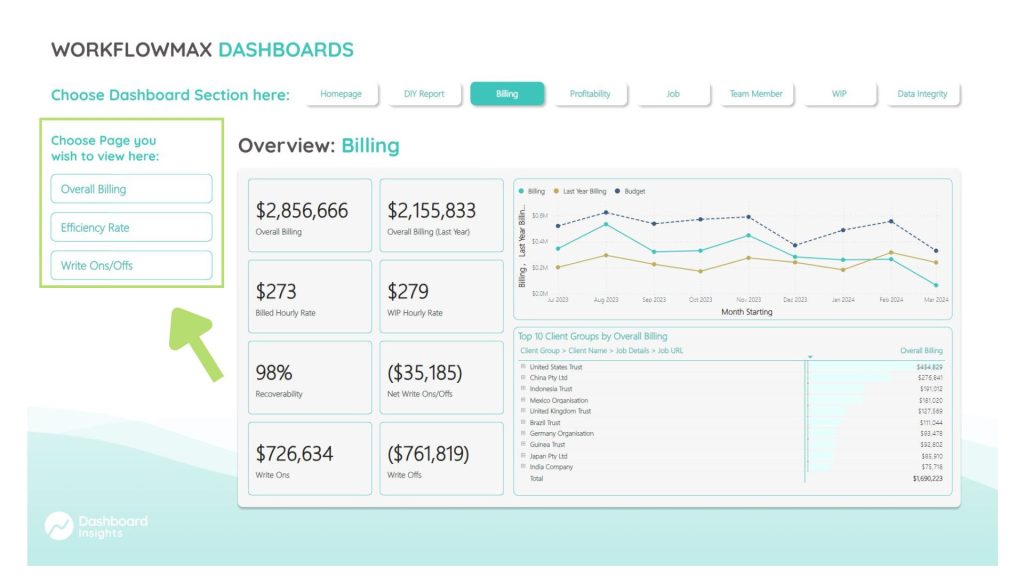

Navigate each dashboard

To begin navigating your dashboards, head over to the left-hand menu on the main screen.

This menu is your gateway to different dashboards with different data and reports for your needs.

Select the dashboard you want to view.

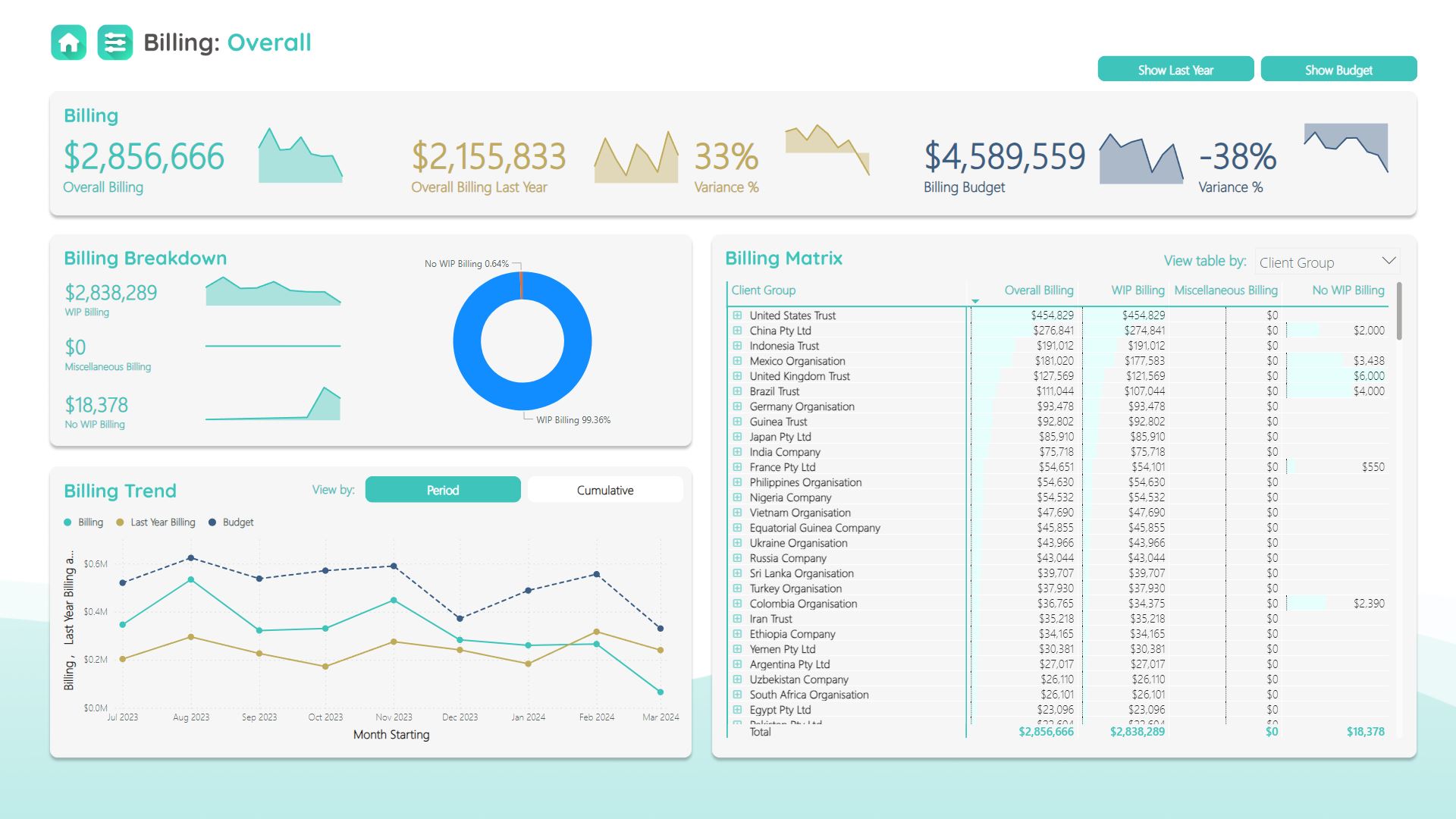

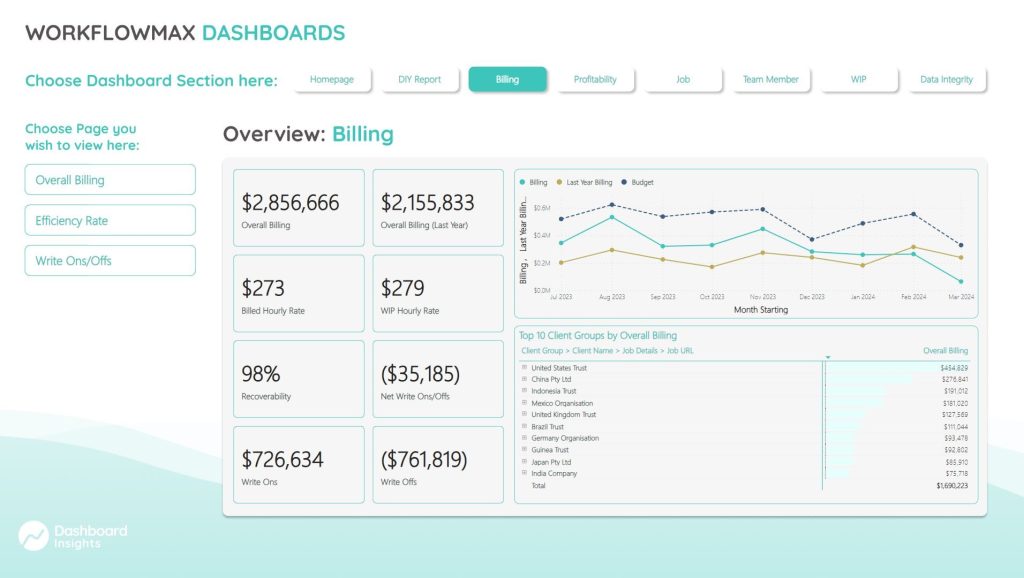

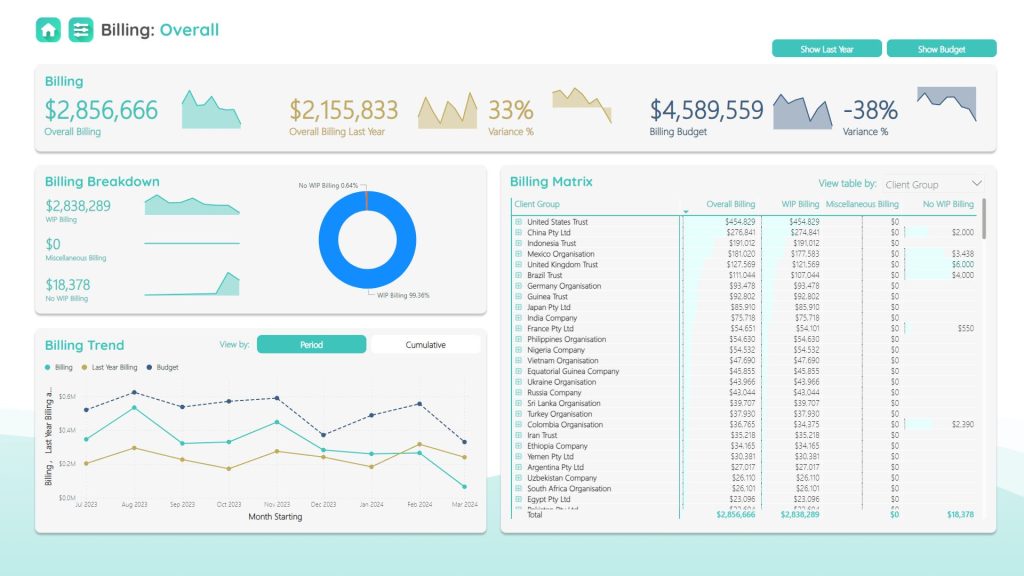

As an example, here is what the Billing dashboard looks like.

The Billing dashboard is a powerful tool for managing your financial data and gaining insights into your business' billing health.

To access more detailed reports, begin by selecting the specific billing data you wish to see on the left-hand side of your screen.

For example, this is what the Overall Billing looks like.

From this page, you can further filter the data by clicking the filter icon on the top-left corner of your screen.

Similar to the WFM Dashboard Homepage, you can filter by date range, client details, job specifics, and staff attributes.

Master navigating your dashboards by clicking through the other pages and reports your WFM Dashboards are packed with!

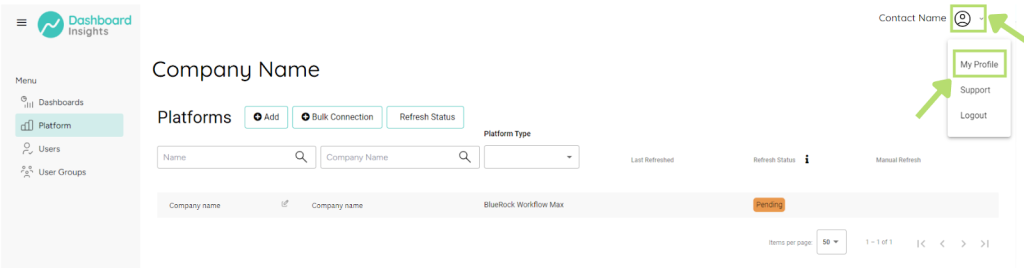

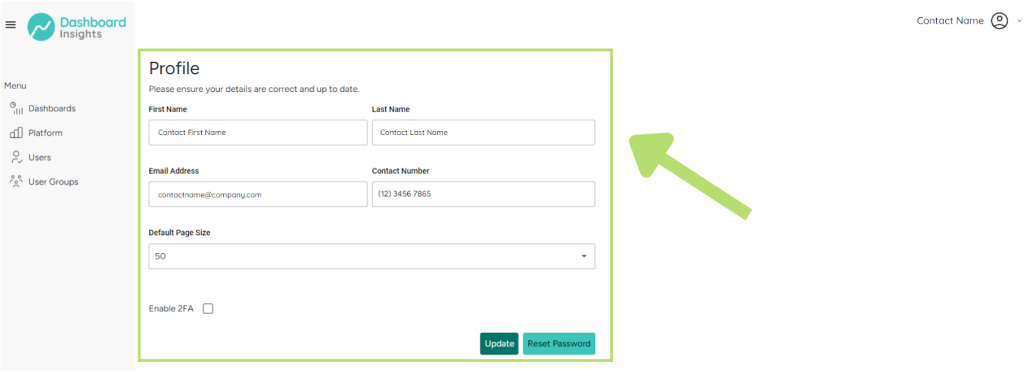

Step 3: Update Profile Settings

Keeping your profile updated is essential for us to stay in touch and for your team to recognise you.

Here's how to keep your profile current:

On the top right corner of your screen, click the dropdown button and select "My Profile."

Once on the "My Profile" page, you'll see fields for your personal details.

Let's walk through updating each section:

Enter your First Name and Last Name as you'd like them to appear to other users on the dashboard.

Provide your Email Address as this is crucial for receiving notifications and updates.

Input your Contact Number to enable a direct line of communication when necessary.

Choose your Default Page Size from the dropdown to determine how many entries you'll see per page on your platform.

For an additional layer of security, check the box to Enable 2FA (Two-Factor Authentication) and follow the prompts as suggested on your screen.

After you've entered all your information, hit the "Update" button to save your changes.

If you need to change your password, simply click "Reset Password."

Keeping your profile updated is key to a personalized and secure experience with WFM Dashboards.

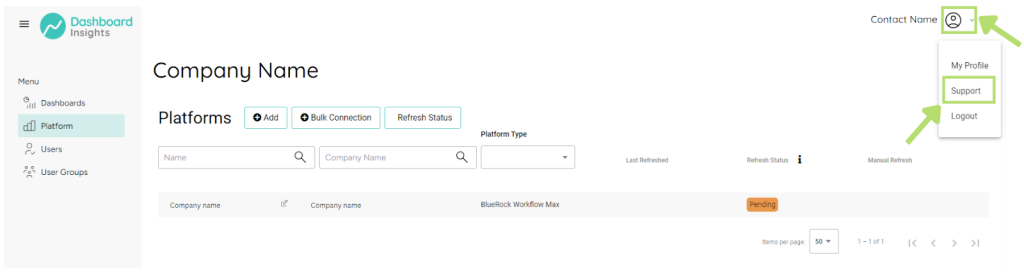

Step 4: Access Support

Feeling stuck or just have a query?

Don't worry, the Dashboard Insights support team is on standby to help you out.

Here's how to reach out for help:

Head over to the top right corner of your screen and select “ Support”.

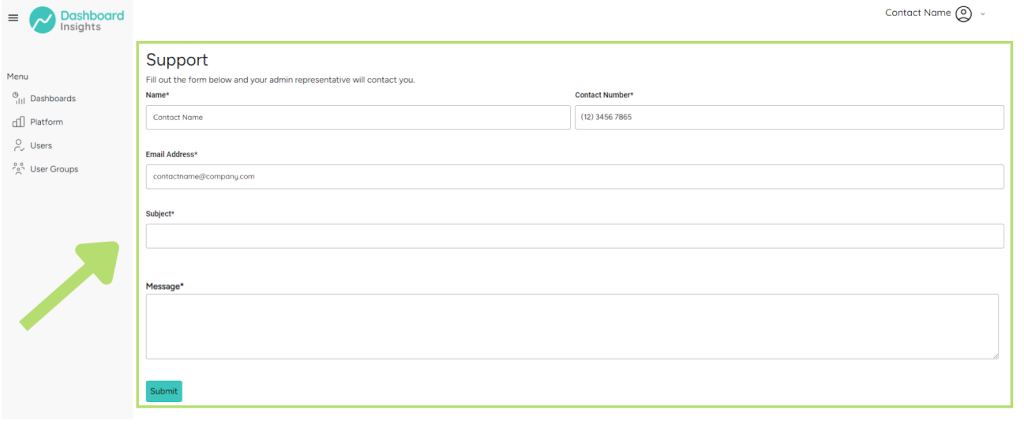

On the "Support" page, you'll find a straightforward form to guide you through submitting a support request:

Input the Subject of your enquiry to give us a quick heads-up on what you need help with.

Next, describe what’s on your mind in the Message field.

The more details you provide, the better we can tailor the assistance to your needs.

Prefer to reach out directly via email?

Drop a line at support@dashboardinsights.com for any further questions or concerns.

Need guidance on how to cancel your service or update billing details?

Also direct those emails to support@dashboardinsights.com and we will get you the personalized help you need.

Congratulations!

You’re now ready to fully utilize the WFM Dashboards.

Dive in, explore, and optimize your business operations like never before.

January 2024 – Dashboard Insights, known for unlocking key data and metrics for accounting and bookkeeping firms, is proud to announce the appointment of Campbell Ross as Business Development Manager.

Campbell is renowned for his impactful roles at APS, Reckon, and The Access Group, where he excelled in fostering strategic partnerships and business development.

Ryan Richardson, Founder of Dashboard Insights, expressed his excitement about Campbell’s appointment: "We are happy to have Campbell on board. His expertise and experience in the industry align perfectly with our mission at Dashboard Insights. Together, we're looking forward to helping more accountants and bookkeepers harness the power of our platform, driving efficiency in their operations and improvements in their business reporting. Campbell's strategic mindset and industry knowledge are invaluable as we continue to enhance our offerings and empower firms to make data-driven decisions."

Campbell Ross shared his enthusiasm for his new role: "Joining Dashboard Insights is a fantastic opportunity. Coming off of a huge win as the Xero Practice App of the Year FY24, I’m sure it’s going to be a fun ride. I’m excited to contribute to the growth of Dashboard Insights and help more firms unlock their potential through our solutions."

With Campbell Ross at the helm of business development, Dashboard Insights is set to further its reach and impact in the accounting industry, continuing to provide solutions that offer valuable insights in an informed and visually engaging manner.

Dashboard Insights, known for its commitment to unlocking key data and metrics to improve firm performance, offers a comprehensive solution that simplifies access to crucial business information, including staff productivity, WIP, partner billing, and more, all in one place. The platform is designed to make every team member a key player in a firm’s success, providing up-to-date KPIs and business metrics without the need for custom spreadsheets.

For more information about Dashboard Insights please visit our website.

About Dashboard Insights

Dashboard Insights is a leader in connecting data to stunning dashboards, making data-driven decisions easier than ever for accounting and bookkeeping firms. The platform enhances productivity, profits, and cash flow, coupled with streamlined operations for increased efficiency and reduced costs. It empowers staff with real-time performance insights, driving continuous improvement and making firms a magnet for top talent.

Keeping on top of your accounting firm’s Work in Progress (WIP) is vital for tracking your practice team’s performance, staying on top of utilisation and making sure you’re billing out to clients in the most effective way. But good WIP management is also a critical factor in keeping your engagements profitable and ensuring the firm’s cashflow in a positive position.

How do you manage to drive this performance without cracking the whip (or should that be WIP?) and coming across as the classic micro-manager?

Unlocking the secrets to effective WIP management in accounting firms was the central focus of our recent webinar, hosted by Trent McLaren from Journey and featuring Ryan Richardson, our Dashboard Insights founder and managing partner at TNM Consulting.

Let’s explore the evolution of WIP management and discover how Dashboard Insights can transform the way you and your accounting firm approach WIP management.

The evolution of WIP management

Traditionally, WIP in accounting firms has been a top-down management process. For things to work well, the responsibility fell on the partner or the engagement leader to pull together the right WIP information, to analyse that data and to then disseminate this to their team.

But, as Ryan pointed out during our recent webinar, this top-down approach is a highly ineffective way of getting on top of your firm’s WIP.

“So if you think about my role five years ago, it was very much about top-down management of our WIP. I would have to go and get a whole lot of information, pull it out of our practice management solution, and then start to collect the information in some sort of a way that was digestible for our team.”

“Firstly, the reality is that this took me a lot of time. But, secondly, I then had to disseminate that information, which involved a lot of time inefficiency.”

This inefficiency and lack of easily accessible WIP information was one of the key drivers for Ryan to build Dashboard Insights.

With practice information centralised and delivered through our various dashboard templates, the firm could quickly get on top of WIP. And by removing Ryan as the ‘bottleneck’ in the management process really served to empower his team.

“Managing our WIP is now efficient and transparent. Everyone has access to the right information at the right time, rather than just when I've decided to collate it. Realistically, that's assisted our team to really take control of their WIP.

So, I no longer have this situation where I've got this top-down management responsibility for managing WIP. The reality is that our WIP control process is driven from our team members up.”

And that ease of access to WIP information has transformed the WIP management process. It’s now a team-empowered process, rather than a top-down management chore.

Understanding WIP and its impact for the firm

Ensuring that your team is tracking well on engagement work and is supplying all the right deliverables on schedule is a big part of the management process on a job. But your WIP management also has a significant impact on the firm’s current cashflow position and your profitability on the engagement. If work is left unbilled for too long, there’s a danger of tipping the firm into negative cashflow and damaging the financial health of the business.

In a professional services firm – whether that’s an accountancy firm, or a law firm – WIP can be broken down into three basic areas:

- Timesheet-related WIP

- Disbursements

- Interims

And, as Ryan explained in our webinar, understanding these three elements of WIP is very important when you’re aiming to keep the firm on a solid financial path:

“When we come back to WIP, there are three main components. First off, there’s timesheet-related WIP, so timesheets multiplied by an hourly rate to provide a timesheet value of WIP. Or, in other words, WIP that’s made up of unbilled time.”

“The second component is disbursements, so, for example, incurring a subscription or a legal fee on behalf of a customer or whatever it may be. So, disbursements on your WIP are costs incurred by the practice that are not yet billed to a customer.”

“And then the third component is the concept of interims, which is essentially deposits or recurring billing amounts that are not yet washed up or connected to a particular timesheet.”

In short, if these three components of the firm’s WIP are well controlled, you'll be converting your productive hours into billing sooner, rather than later. That helps you drive cashflow and profitability of the business.

Dashboard Insights as the key overview of your firm’s WIP

So, managing your WIP efficiently isn’t just a performance thing. It’s a vital part of helping the firm stay in a liquid cashflow position and bringing in meaningful profits. But to drive the team-empowered approach we mentioned, you need deep, accessible insights into your WIP.

Dashboard Insights is a powerful tool for getting a clear overview of your WIP data. But it’s also an incredibly useful tool for addressing the main pain points associated with WIP management.

The big pain points when managing your WIP come down to:

- Poor profitability and poor cash flow – the number of practices that struggle with cashflow and profitability can be surprising. The answer, at base level, is to maintain the firm’s revenue and to have that productive hours-to-billing conversion going on.

- The ageing of WIP – the longer WIP stays on the shelf and remains unbilled, the less recoverable it is. So, actively and effectively managing your WIP means that you've got more recoverable work to bill out to the client – and that’s great for your cashflow.

- Individual responsibility for WIP – every individual in the firm needs to play their role in managing WIP. It’s this collective responsibility for keeping WIP under control and billing out effectively that drives the fundamental financial health of the business.

These pain points are pretty much universal, whatever the size of your firm. But when you have the right WIP, billing, cashflow and revenue metrics in front of you, it’s far easier for the whole team to get proactive with their WIP management.

Dashboard Insights offers a multi-faceted approach to your WIP management. At the individual level, your team members can now track the most important WIP-based key performance indicators (KPIs), focusing their efforts on productivity, billing, recoverability, and WIP.

In a nutshell, this is what Dashboard Insights does: as an operational tool, it shows you the WIP numbers you need to see and puts you back in control.

As Ryan explains, developing Dashboard Insights and plugging it into his firm’s WIP process has been transformative for TNM Consulting:

“Five years ago, it was really the responsibility of too few people in our organisation to manage WIP. Now it's everyone's responsibility, and the organisation is empowered, appropriately and realistically. We've almost halved our WIP days over a period of time without changing our billing structure. Over three and a half years of managing WIP with Dashboard Insights, we’ve nearly halved our WIP days.”

That’s a stat you can’t really argue with, and shows just how important Dashboard Insights has become in keeping TNM Consulting on top of their WIP management game.

Dashboard Insights: don’t crack the whip, collaborate on your WIP

Mastering your WIP management is a crucial element in making your accounting firm a financial success story. What emerged from our webinar was that Dashboard Insights is a game-changing tool when your firm’s WIP is starting to get out of control

Don’t rely on the traditional, top-down approach of putting responsibility for WIP with a senior partner. Instead, integrate Dashboard Insights into your practice tech stack and give the whole practice team access to their WIP KPIs and performance metrics.

If you’d rather collaborate on your WIP and leave the whip at home, Dashboard Insights is the reporting and KPI tool you need at the heart of your WIP process.

Putting your accounting firm on the market is a giant step for any partner. It will have taken you years, if not decades, to grow this practice and nurture it into the success story it is today. That's taken time, effort and a whole lot of dedication – so selling up and parting ways with your legacy can be a hard prospect to consider, both strategically and emotionally.

But with a clear exit strategy, and an awareness of the underlying value of your firm, you know you have a routemap for getting the best from the sale of your practice.

Here's our quick guide to selling up, with five critical elements to include in your exit strategy

1. Set clear goals and objectives for the sale

The first step in developing your exit strategy plan is to know WHY you’re selling up, and to set some clear goals and objectives for the sale. These goals will help guide your planning.

Sit down with your partner group and ask some important questions about the sale:

- What do you hope to achieve by selling your accounting firm?

- Do you want to maximise the value of the firm and your own end profit?

- Do you want to sell to a buyer who shares your values and will continue your legacy?

- Do you want to pass the firm onto the next generation, whether that be a family member or an internal firm successor?

- Are you looking to be bought out by a competitor or larger group?

There may not be an immediately clear answer to these questions, but it’s important that there’s agreement between the partners and a shared desire to sell up – either the whole firm, or just your own stake in the business as a partner.

Once you’ve agreed and decided on your goals and objectives, you can begin to develop a plan to achieve these end results.

2. Develop a timeline for selling up

A good exit strategy plan should include a timeline for achieving your goals and objectives. This will mean setting key milestones that tally with your goals for the sale, so there are agreed deadlines and a sense of impetus and motivation behind the sale of the firm.

Be realistic about these timelines and take into account factors such as the current market conditions, time needed for pre-sale housekeeping, and the time it may take to find a suitable buyer. It’s important to be flexible and to adjust the timeline as needed, but having timescales in place will help you to stay on track and make progress towards your goals

3. Identify potential buyers who fit the bill

Once you have a timeline in place, you can start the task of finding a suitable buyer for the firm. That might sound easy, but sourcing exactly the right buyer can be challenging.

If you’re passing on the firm to the next generation of your family, or have trained up a successor who is willing to buy you out, then finding that buyer is a lot easier. But if you’re putting the firm out on the open market, it may take more time to locate a buyer that meets your requirements – and is willing to offer a price that matches your objectives for the sale.

Here are some ways to widen the net and haul in your ideal buyer:

- Network with other accounting professionals and get word out in the industry

- Attend industry events where you can talk to a wider group of potential buyers

- Work with a business broker or M&A specialist, who can help you find interested buyers and secure a beneficial deal.

Purchasing your firm is an investment opportunity for the buyer, just like any other mergers and acquisition (M&A) activity. So, ensuring that the firm has good financial, sales and revenue potential will make it much easier to attract your ideal buyer.

4. Prepare the firm for sale (and increase the value)

The value of your firm can be divided into two areas: the tangible and the intangible. The tangible things are the assets in the firm and the price that a potential buyer is willing to pay for the practice. The price you can achieve will be dependent on the market, but it’s worth looking at industry benchmarking and recent sales to gauge a potential asking price.

But let’s not forget about the firm’s intangible assets. These are things like the satisfaction levels of your client base, the skills of your practice team and reputation of your brand in the market – all key drivers of whether the practice is seen as a good firm to buy out.

A core part of your exit strategy is to add value to the firm in the months, or years, preceding a sale. This means making the firm a viable and attractive business proposition, while doing everything in your power to add both tangible and intangible value to the firm.

This might mean:

- Getting your finances in order – ensuring the firm is in a positive cashflow position, with great revenue projections, will appeal to your buyer and allows them to see the potential for turning a profit and making money from this enterprise.

- Having the best data at your fingertips – buyers will want to see sales figures, profit margins and operational expenses before they dive into a sale. That means having an excellent reporting and dashboard system, with key metrics in place.

- Resolving any legal issues and snags – buyers don’t want to get caught up in legal wrangles and court cases. So, if you have any legal proceedings or HR issues in place, it’s best to try and bring these to a close before you attempt to sell.

- Retaining and attracting the very best talent – your staff are one of the most important assets you’ll be selling, so it’s vital that your practice team has the experience, abilities and soft skills to appeal to any prospective buyer.

- Streamlining your workflows and processes – a big intangible element is how well the firm works at an operational level. A firm using paper and desktop accounting is a far less attractive prospect than a cloud practice with automated workflows.

- Getting a succession plan in place – if your practice staff would be ported over in the sale, you’ll need to be clear about which roles are staying, who’s taking on the running of the firm and what the long-term strategy is for finding a new MD and leadership team.

It’s important to be transparent with your potential buyers, so you give them an honest and transparent view of the firm. The more you can do to provide numbers, metrics and evidence of the firm’s viability, the better your pitch will be when it comes to striking a deal.

5. Negotiate a deal that works for you and your buyer

Finding a buyer may take some time. But once you have an interested party, it’s time to get down to the serious business of negotiating the sale conditions, price and terms of the deal.

Negotiating the purchase price is an area where market knowledge and a sense of diplomacy will be very helpful. If you’re negotiating the sale through a broker or M&A specialist, they will be able to carry out some of the key negotiations on your behalf. But, even if you’ve sourced your own buyer, it’s sensible to work with a qualified adviser and legal team, so you cover all the right legal bases and have an airtight contract and price in place.

It will also be important to agree on a transition plan as part of your wider exit strategy, so there’s a clear handover of ownership, leadership and firm responsibilities.

Dashboard Insights: shining a light on the metrics that matter

The earlier you start your exit strategy planning, the more time you will have to add value to the firm and get the operational elements of the business reviewed, improved and updated.

At Dashboard Insights, we understand just how vital it is to have in-depth reporting and key metrics available to share with your prospective buyers. Our dashboards for accountants will track your financials, revenue, profitability and cashflow – in fact, all the key financial numbers your buyer will want to review during the negotiation process.

Using our dashboards, you’ll be able to share:

- Real-time insights into the financial and non-financial health of the firm, so prospective buyers can gauge the viability of the business.

- Customisable dashboards that can record, track and reveal all the important key performance indicators that you should be tracking while adding value to the firm.

- Alerts and notifications that tell you when your key metrics and KPIs reach certain thresholds, so you and your buyer can be transparent about performance and targets.

Dashboard Insights for accountants is the simple way to turbocharge your metrics and design a practical KPI dashboard for tracking your firm’s value.

If you’re aiming to sell your accounting firm in the near future, Dashboard Insights helps you track the big metrics that measure the value and viability of your accounting business.

When you're busy running an accounting firm, there's not always time to step back and think about the journey you've been on. But it’s important to stop and take stock occasionally. Looking from the outside in, you have a chance to see how your client base has grown, how your team has expanded and how your in-house services have evolved to meet client needs.

Taking time out to review your evolution as a firm isn't just about sentimentality, though. This is a golden opportunity to review the underlying value of the firm, the quality of the practice and what the firm may be worth – both in financial, reputational and legacy terms.

So, where do you start when considering the value of your firm? And what are the important metrics to pay attention to when tracking your value over time?

What do we really mean by ‘value’?

Value. It’s a term that gets thrown around a lot in business circles, but it’s not always 100% clear what we mean when we talk about the value of a firm or business.

It can mean the financial value of the firm, of course, and what a prospective buyer might pay to acquire the business. But value can also be about the perceived worth of the firm for its many stakeholders. How much value does the firm hold for you, as a partner and owner? How do your clients perceive this value and the benefits that you bring to their company? And how do your team members gauge the perks and advantages of working for your firm?

The perceived value of the firm comes from a mix of all of these things. The potential sale value in the market. The brand reputation you have as a team of advisers. And how you’re seen as an employer, a professional services firm and an asset to the business community.

Knowing how your firm strategy can drive value

Understanding the value of the firm isn’t just about making a financial assessment of your assets and balance sheet. There’s also the prospect of how this value may drive your thinking as a partner group and your long-term goals for the firm and the partnership.

Understanding your short, medium and long-term goals for the practice is important, and will be tied in closely to the potential value that you and your fellow partners see from the firm:

For example:

- Are you looking to grow the firm in the medium term? – if your plan is to grow, it’s vital to focus on attracting and retaining new clients. This might mean investing in new technology to improve your client experience, expanding your service offerings or embracing different digital marketing channels. There’s also a need to develop and train your staff and to create a culture that attracts and retains top accounting talent.

- Are you looking to welcome new partners into the firm? – expanding the partnership means making the firm as attractive as possible to potential partners. Think about improving the firm's reputation, culture and financial performance, and develop a clear plan for how new partners would be integrated into the firm.

- Are you expecting to hand the firm to the next generation? – handing the firm to your children, or chosen successor, is about securing the long-term future of the firm and passing on your hard-won legacy. A strong succession plan will be essential, in tandem with a leadership training programme that develops a new generation of future leaders.

- Are you planning to sell the firm in the near future? – selling the firm will be reliant on potential buyers seeing the tangible and intangible value of the practice. This will be driven by your financial performance, marketability as a practice, and the quality and depth of your succession plan. It’s also vital to have a firm grip on the firm's finances and to have simple access to all the big numbers your potential buyer might want to see.

A real-time window into your firm’s metrics and KPIs

But which key performance indicators (KPIs) and firm metrics should you be tracking? And what do they tell you about the underlying fitness and value of the practice? The exact metrics that matter to your firm will be unique, but there are certain fundamental KPIs that every practice should be recording, reviewing and analysing on a regular basis.

We’ve highlighted five of the most important value-based metrics:

- Revenue growth – the firm’s revenue growth is a key indicator of the health of an accounting firm. As a partner group, you should be tracking revenue growth over time, looking for variances against your forecasted revenue goals, and benchmarking your revenue growth against industry standards and prevailing trends in the sector.

- Profitability – Profitability is another key indicator of your success and your profit-focused KPIs should be central to your reporting. Important metrics to keep an eye on will include your net profit margin and your operating profit margin as a firm.

- Client retention – it’s far cheaper to hang onto an existing client than to try and win a new client. Because of this, it’s essential to focus on client retention techniques and to track your retention score over time. Checking this metric on a regular basis helps you spot the client issues and get proactive about improving your client experience.

- New client acquisition – tracking how well the firm is attracting new clients is another good measure of the perception of the firm in the market. Check that you’re meeting your new client goals and also that you’re attracting clients from the most valuable, desirable or profitable industry sectors or business types.

- Staff turnover – if the firm is haemorrhaging talent, this is generally a bad sign. Your staff turnover is a good measure of your reputation as both an employer and a brand, so a high staff turnover rate can be a sign of problems within the firm. Track your staff turnover rates over time and look for the areas where improvements are needed.

By tracking and monitoring these key metrics, you;ll have a far clearer understanding of where the firm is doing well, where core improvements are needed and how the health of the practice is affecting your overall value and reputation as an accounting firm.

Dashboard Insights: shining a light on the metrics that matter

At Dashboard Insights, we know the importance of having detailed, real-time metrics at your fingertips. Our dashboards are designed to help your accounting firm get back in the KPI saddle, with tailored reporting that reveals the true value of your practice.

- Real-time insights – our cloud-based dashboards give you real-time insights into your firm's performance and health, with metrics that help you quickly track your progress, identify trends and patterns and make evidence-based business decisions.

- Customisable dashboards – we can easily tailor your custom dashboards, giving you the visibility you need to track the metrics and KPIs that are most important to the firm. It’s the simplest way to stay on track of your performance and value KPIs.

- Alerts and notifications – Dashboard Insights can be configured to send alerts and notifications to users when your key metrics and KPIs reach certain thresholds. This allows the firm to stay ahead of potential issues and quickly jump on the problem.

Dashboard Insights is the simple way to turbocharge your metrics and design a practical KPI dashboard for tracking your firm’s value.

Whether you’re looking to track profitability, new client sales or staff retention, you’ll always have the numbers you need to drive your success story.

Effective work-in-progress (WIP) management is not just a fundamental practice for accounting firms—it's critical to financial stability and client contentment. High WIP days, indicating pending work and uninvoiced services, can significantly impact cash flow and overall profitability.

In this blog, we will delve into actionable strategies to reduce WIP days from 48 to 24, facilitating faster billing and elevating operational efficiency.

Understanding the Challenge

Before we delve into the solutions, it's crucial to comprehend the potential consequences that can arise from high WIP days. Work-in-progress encompasses billable time and services not yet invoiced to clients. Therefore, elevated WIP days can directly impact cash flow and profitability.

Reducing WIP days isn't just about financial benefits—it's about creating an environment where your accounting practice can flourish. By addressing this challenge effectively, you set the stage for improved productivity and quicker, more efficient operations.

Strategies to Reduce WIP Days and Expedite Billing

1. Streamlining Workflow and Task Prioritisation

Establishing a structured workflow is the cornerstone for streamlining your operations. Analysing and optimising your processes can help eliminate potential bottlenecks and redundant steps.

Clear Task Priorities: Ensure urgent and high-value tasks are promptly addressed. By prioritising these tasks, you can expedite their completion and billing.

Organised Workflow: A clearly stepped-out workflow ensures smoother task progression and reduces unnecessary delays. A roadmap of tasks and their dependencies, can minimise idle time and keep the workflow steady.

2. Emphasising Effective Communication and Collaboration

Efficient communication plays a vital role to reduce WIP days. Cultivating an environment where team members can openly communicate project statuses, challenges, and deadlines establishes avenues for updates and collaborative problem-solving.

By promoting a culture of effective communication, you enable your team to work cohesively towards common goals. When everyone is on the same page, tasks are completed more efficiently, and billing can happen promptly upon task completion.

3. Leveraging Technology and Automation

In today's tech-centric age, powerful solutions are available to minimise WIP days and expedite billing.

Modern Accounting Software Implementation: Automating repetitive tasks and providing real-time insights into project statuses can significantly reduce WIP days. By automating routine tasks, your team can focus on high-value activities, ultimately fast tracking billing processes.

Integration of Project Management and Accounting Systems: Aligning project management tools with accounting systems ensures accuracy and accelerates invoicing. Seamless integration allows for a direct flow of project data into the invoicing process, reducing manual effort and potential errors.

Taking control of the automation process lifts administrative burdens, enhancing the accuracy and efficiency of the billing process.

4. Continuous Process Review and Improvement

No company can thrive without regular process reviews, as they are an integral component in the identification of areas of improvement.

Soliciting Feedback: Actively seek feedback from team members and clients to offer diverse perspectives on your firm's operations. This feedback can reveal inefficiencies or areas where streamlining is needed.

Data Analysis: Analysing the data and feedback provided by team members allows for the refinement of strategies. By identifying patterns or recurring issues, you can tailor your approach to mitigate these challenges effectively.

When you establish a work culture that prioritises continuous refinement, you enable your firm’s processes to remain efficient and effective over time.

Incorporating Dashboard Insights for Expedited Processes

An invaluable tool in this endeavour is leveraging Dashboard Insights. This sophisticated platform offers real-time data visualisation, enabling quick identification of project statuses, resource allocation, and potential bottlenecks.

Full workflow view: Dashboard Insights do this by transforming client, invoice, cost, job, task, employee, time sheet, and budget data into a meaningful set of insights which surfaces the right information, to the right people, at the right time. Dashboard Insights helps firm owners understand what’s going on in their firm and gives them peace of mind that they are focusing on solving the right problems.

Real-time Decision-making: With instantaneous insights provided by Dashboard Insights, informed decisions can be made promptly, making workflow faster and reducing WIP days. Real-time data ensures that the team is always aware of the project's status and progress.

A new approach

Harnessing technology and fostering a culture of agility and efficiency will assist to position your firm for long-term success. It can help strike a balance between productivity and client satisfaction.

With the aid of Dashboard Insights, this journey becomes even more streamlined and efficient, paving the way for a successful and prosperous accounting practice.

By taking a proactive approach and embracing innovation, your firm can navigate the intricacies of billing and WIP management effectively. Here's to a future of optimised operations, satisfied clients, and a thriving accounting practice!

In the dynamic realm of accounting, efficiency is an essential piece of the puzzle. In order to ensure success, the following become imperative:

- Measurability

- Tangibility

- Being indispensable

Recently, the Metrics that Matter Webinar brought these points to the forefront, revealing how accounting firms can decode profitability through the establishment of precise KPI’s and strategic insights.

Dashboard Insights Founder, Ryan Richardson, was pleased to welcome industry leaders to the discussion, including Director of Business Depot, Rebecca Mahalic, along with Director of Future Advisory, Jason Robinson, and Founder of Journey, Trent McLaren.

Here we reveal the critical insights shared by these experts that can reshape modern accounting practices.

Tailoring KPIs to Your Firm

Experts reminded us that KPIs aren't a one-size-fits-all solution. KPIs should be tailored to align with the specific goals and nature of each firm.

Dashboard Insights Founder, Ryan Richardson, emphasised this by dividing KPIs into four key areas:

- Partnership Level: Focusing on top-line, bottom-line, and client service metrics.

- Manager Level: Balancing top-line focus with a production-oriented approach.

- Accounting Level: Shifting towards self-focus while maintaining billing as a key metric.

- Administration Level: Prioritising accountability through metrics like database management and timesheet completion.

Understanding these nuanced levels of KPIs enables firms to measure progress effectively and drive growth in a direction that resonates with their unique organisational structure and aspirations.

Ryan went on to further explain the partnership level, which is highlighted by a ‘three-pronged focus’: top line, bottom line, and client service. Here, KPIs like billing, profitability, efficiency rate (or average hourly rate), and the essential service matrix take centre stage. These metrics form the bedrock for assessing the firm's financial performance and aligning strategies accordingly.

Empowering Growth through KPI Optimisation: TNM Consulting

Dashboard Insights was born out of an accounting firm, TNM Consulting, to solve typical problems of professional services business such as operational and reporting efficiency, workflow, and WIP management.

The success journey of TNM Consulting was shared during the webinar, showcasing the transformative power of effective KPI management.

Starting as a modest 10-person team, they navigated their trajectory with a focus on managing key metrics efficiently, overall visibility, and team empowerment. Their growth story, scaling to today's team of 35 illustrates the symbiotic relationship between vigilant KPI tracking and business expansion.

For TNM Consulting, the manager level introduces a production-oriented approach while maintaining a focus on the top line. Here, metrics like billing, productivity, recoverability, and work-in-progress (WIP) days take precedence.

Having a data-driven approach, like TNM Consulting, ensures not only a profitable business but also streamlined operational efficiency.

Understand How Firm Time Is Spent

Rebecca Mahalic from Business Depot shared sentiments from all experts about the importance of tracking each team member’s time.

For a firm with a keen focus on growth and productivity, making sure that the team is doing their timesheets is critical. There also needs to be those responsible for ensuring this is accounted for and making timesheets a key metric.

In this inflationary environment where pricing and profitability is so important, there is value ensuring every single minute that people are spending is the best minute that they can be spending in the business.

Culture Matters For KPI Tracking

Jason Robinson of Future Advisory recognised that a culture shift to track timesheets and activities was a tough but necessary step to enable:

- Profitability. Stricter focus on higher profit services and controls on time spent to improve quoting, enable a more helpful sales process and make a team more efficient.

- Team empowerment. Once the team gets how it all bolts together, using the data to the bigger picture of what a successful business looks like, man, then they are all of a sudden working smarter.

- Client engagement. With a clearer vision on what it takes to run a successful business, it’s easier then to go and talk to clients about the value of the service being delivered.

Collaborative Excellence: The Power of Community within the Industry

The webinar celebrated the essence of collaboration within the accounting industry. A united community, merging to discuss challenges, triumphs, and best practices, amplifies collective knowledge. Professionals openly sharing experiences, failures, and breakthroughs foster a culture of continuous improvement.

This collective wisdom enriches the industry's knowledge base, and creates a thriving community poised for overall success.

The accounting level brings a self-empowered approach, encouraging accountants to delve into their activities while still keeping a billing focus. Key metrics include job turnaround time, income tax lodgements, and work-in-progress (WIP). This granular focus empowers individual accountants, ensuring they are accountable for their contributions.

Guiding the Path to Success Through KPI Mastery

The webinar illuminated the path to success through KPI mastery. The true potential for firm growth and productivity is unlocked by recognising the nuanced ways KPIs can be tailored to the specific firm DNA.

An invaluable tool to make better decisions is leveraging Dashboard Insights. This sophisticated platform offers real-time data visualisation, enabling quick identification of job statuses, resource allocation, and potential bottlenecks. This is particularly helpful to gain confidence with:

- Pricing and profitability - Firms must understand their costs, particularly in their fixed-fee engagements. Dashboard Insights know that firms struggle to price engagements based on real data. With inflation running hot, Dashboard Insights support firms in repricing their clients and better understanding what service lines are profitable.

- Job & Client Visibility - Firms often struggle to have visibility over work-in-progress and job status. This often results in issues of “pick-up, put down”. Many firms carry WIP with the hope of billing it. Dashboard Insights identify problem areas, and address these before jobs are closed and to help close jobs quicker.

KPIs Sailing to Success

KPIs are somewhat similar to the art of sailing (Bare with us... It’s a metaphor worth sharing). It's about setting the right course, adjusting your sails according to the wind, and, most importantly, leveraging the power of a well-knit crew (and the accounting community!). With KPIs serving as a compass, we navigate the seas of accounting, steering our ships towards profitability, efficiency, and sustainable growth. That sounds alright, doesn’t it?!