Profitability in the accounting industry isn't simply about revenue earned. It's directly influenced by a handful of key performance indicators (KPIs). These KPIs, although appearing as just numerical data, offer valuable insights into the financial and operational health of your firm.

In this blog, we'll dive into four crucial KPIs - Productivity, Work-in-Progress (WIP), Billing, and Recoverability. We'll understand their significance, impacts, and how these KPIs will drive profitability and operational efficiency in your accounting firm.

Unlocking the Potential of Productivity

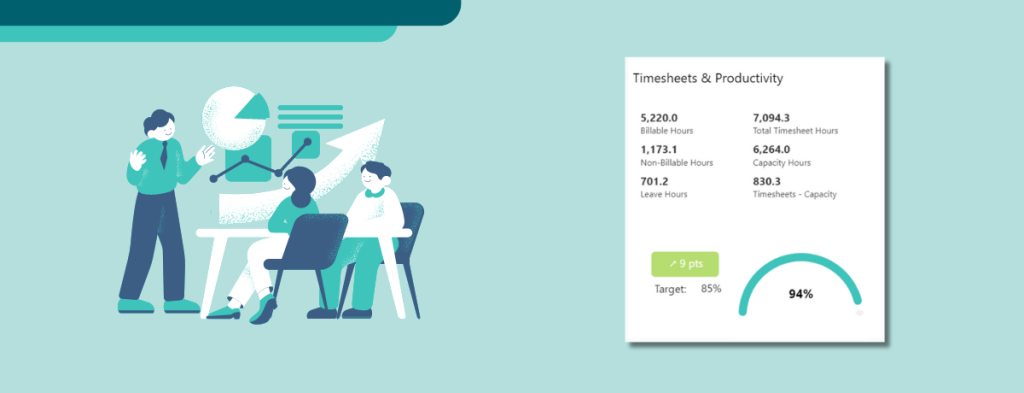

When we talk about productivity, what comes to mind? It's often linked to the amount of work we can get done within a set amount of time. However, in an accounting and bookkeping firm, productivity isn't just about ticking tasks off a to-do list. It's also about the amount of work that can be directly billed to a client. As productivity increases, the billable work that can be billed to the client also increases.

To illustrate, XPM measures productivity as the ratio of billable hours (the time we spend doing client-related work that we can bill) to total hours worked (which includes both billable and non-billable hours). Imagine you have a team that works eight hours a day, but only three of those hours are billable. It means that for more than half of the time (5 hours), the team is doing non-billable work - perhaps administrative tasks or internal meetings. This would reflect a low productivity score. While some non-billable work is always necessary, a high volume of it could indicate inefficiencies in the way a team is working.

Tracking and analysing productivity help identify inefficiencies, enabling you to allocate resources better and maximise billable hours. This lies in assessing what non-billable tasks are taking up most of the time and figuring out how to reduce them. This usually involves a variety of solutions, such as automating administrative tasks or refining internal processes to reduce meeting times.

By successfully identifying and reducing these inefficiencies, we can increase the amount of time available for billable work, increase the amount billed to the client, and eventually increase profitability.

Managing Work-in-Progress (WIP) Efficiently

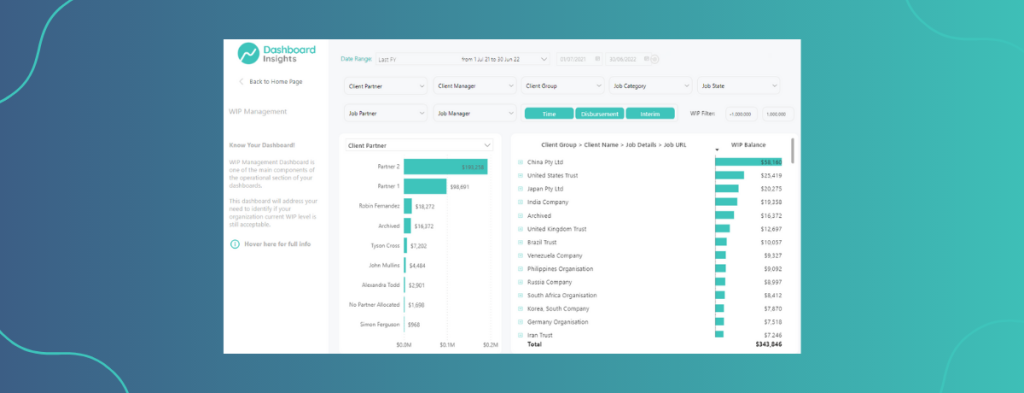

Work in Progress (WIP) is an important KPI for firms as this refers to the work that's already started but not yet billed to clients. WIP Balance increases when team members clock in billable hours or incur job costs and decreases when you invoice clients or clear jobs from the invoice list. This is why a high WIP balance isn't necessarily good news - it could suggest inefficiency, indicating there's plenty of work produced but it's not being turned into invoices quick enough.

The goal in any business, particularly in the accounting industry, is converting as much work as possible into billable revenue in a timely manner. Doing this not only improves your cash flow but also minimises the risk of overlooking any WIP and consequently having to write it off.

So, the question is, how do we manage WIP efficiently? We need to ensure that our WIP balance is not too high and not too low, and moves smoothly from ongoing work to invoiced and, finally, paid work.

Ensure full visibility on WIP to help team members see where they might be falling behind and for them to gain insights on what can be improved on. This helps identify potential bottlenecks that could be slowing down the invoicing process, and it points out areas where you can boost efficiency.

In a nutshell, mastering WIP management is all about streamlining the process and leveraging tools to optimise it. Managing it is an efficient way to increase your firm's profitability and ensure that your team's hard work translates into tangible financial results.

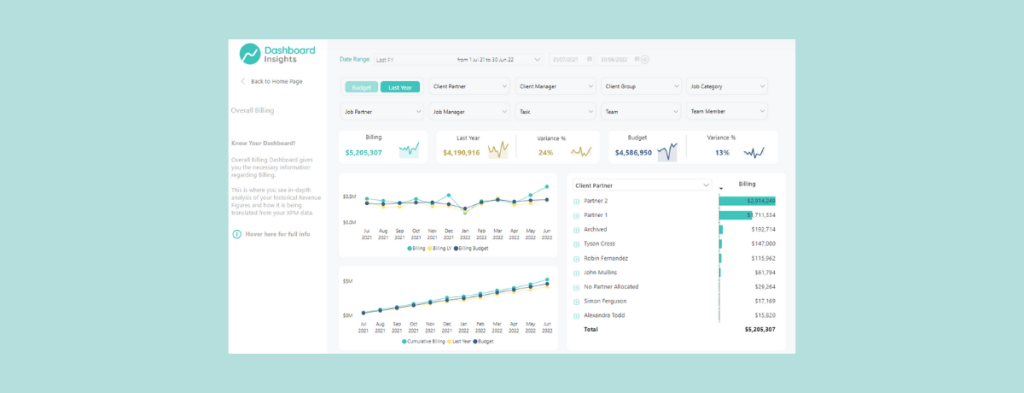

Driving Revenue with Effective Billing

Billing transforms the team's hard work (WIP) into income. However, the focus isn't just on the total billed but on the breakdown—identifying who is generating revenue and from what work type.

Consider this scenario: a team member who's highly efficient in tax advisory tasks consistently contributes to a significant part of the firm's income. Such insight can be instrumental in directing resources and work allocation strategically.

What will help is to have an accurate and clear overview of your billing patterns, showcasing who and what jobs bring in the most revenue to gain actionable insights to enhance your firm's performance.

To summarise, efficient billing will greatly impact profitability. By understanding and managing billing patterns, you’re not only improving your cash flow, but also making data-driven decisions that can push your business towards greater success.

Optimising Profit with Recoverability

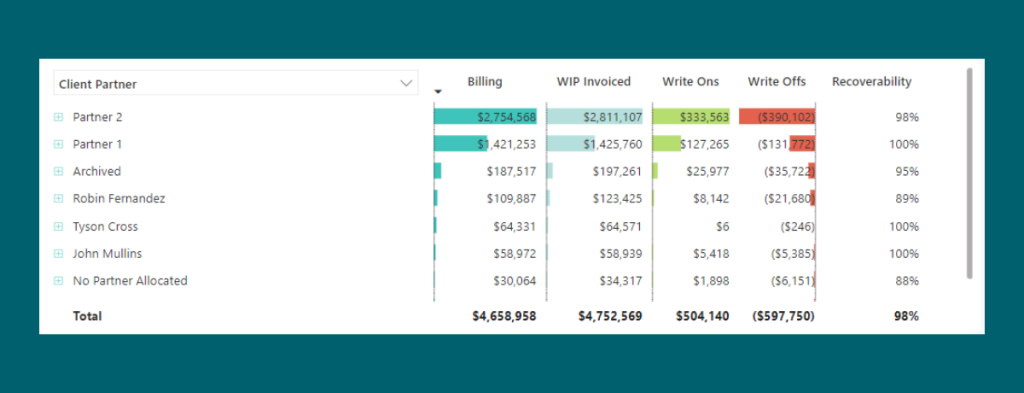

Recoverability measures the proportion of the WIP that is successfully billed to clients. Low recoverability may signal that too much work is being written off or that billing rates are not reflective of the work value.

For instance, you may find that a team member is spending a lot of time on a complex task for a client, reflecting a high WIP balance, but the quality of work does not seem to reflect that and you have decided to write-off some amount. In such cases, you might need to reassess your pricing structure, task allocation, or billing rates to ensure they are reflective of the work value your firm brings to clients.

Monitoring recoverability regularly will provide insights into your billing processes, helping spot patterns and inefficiencies in your business. Ultimately, a higher recoverability rate means higher profitability, and that's a goal worth striving for.

Profitability as a Continuous Journey

Profitability isn’t a single destination but a continuous journey, guided by your firm’s KPIs. It's about fine-tuning your operations, leveraging insights, and making data-driven decisions to optimise running your firm more efficiently based on real-time data. Using data analytics solutions such as Dashboard Insights will enable you to boost your firm's performance by putting the right information in the hands of the right people, at the right time.

At Dashboard Insights, we're here to assist you in navigating and supercharging these metrics. With a deeper understanding of Productivity, WIP, Billing, and Recoverability, you can chart a more profitable course for your accounting and bookkeeping firm.

In our recent webinar, we did a deep dive on team empowerment and data-driven decisions to drive business performance and maximise profits. We explored the practical application of data analytics through our Xero Practice Manager (XPM) Dashboards. Join us as we outline the key takeaways from this enlightening session, providing actionable insights on harnessing the potential of XPM Dashboards to drive business growth and success.

Empowering Teams: A Catalyst for Success

Dashboard Insights helps empower your teams to drive success. When team members have access to accurate, real-time data, they become active contributors to your firm's growth. Every team member can align their efforts towards achieving high performance and profitability goals. By making data accessible to provide actionable insights, XPM Dashboards transform teams into a driving force that propels your firm towards success.

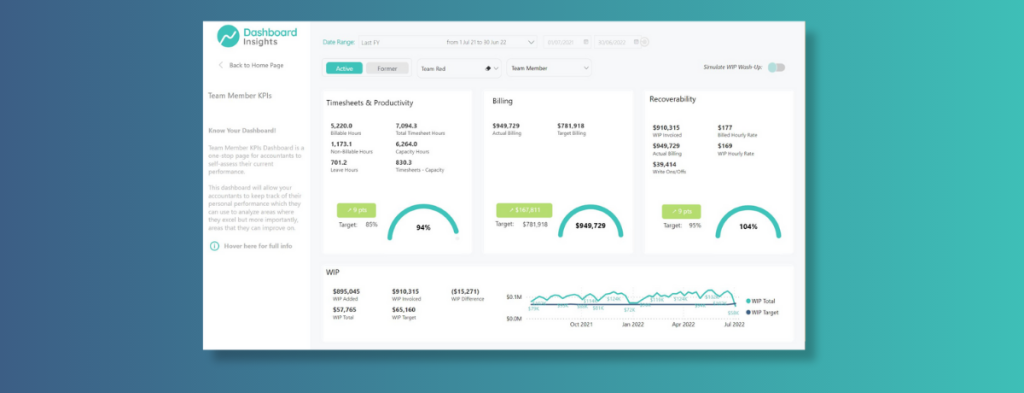

Dashboard Insights: Ensuring 100% Visibility of your Data

Our XPM Dashboards offer a comprehensive and real-time view of your firm's data. By visually presenting key business and performance metrics, our dashboards empower your teams to effectively track essential key performance indicators (KPIs) and make informed decisions. With a glance, you can gain a deep understanding of your firm's billing, recoverability, productivity, WIP, and any other important metrics, enabling you to efficiently manage business operations.

Real Benefits, Transformative Results

The implementation of Dashboard Insights provides remarkable outcomes for accounting and bookkeeping firms. Real-life results have shown our customer's revenue increase up to 2.5 times over a 3-year period and profit growth up to 4 times over the same timeframe. These were driven by a range of factors including a 12% boost in productivity and reducing WIP days in half. These real-world wins demonstrate how our XPM Dashboards turbocharge accounting and bookkeeping firms.

Unleash the Power of XPM Dashboards Today

As the data-driven era continues to shape the business landscape, it's time to harness analytics and supercharge your team with XPM Dashboards. Connect with us today to discover how XPM Dashboards can optimise your accounting and bookkeeping firm.

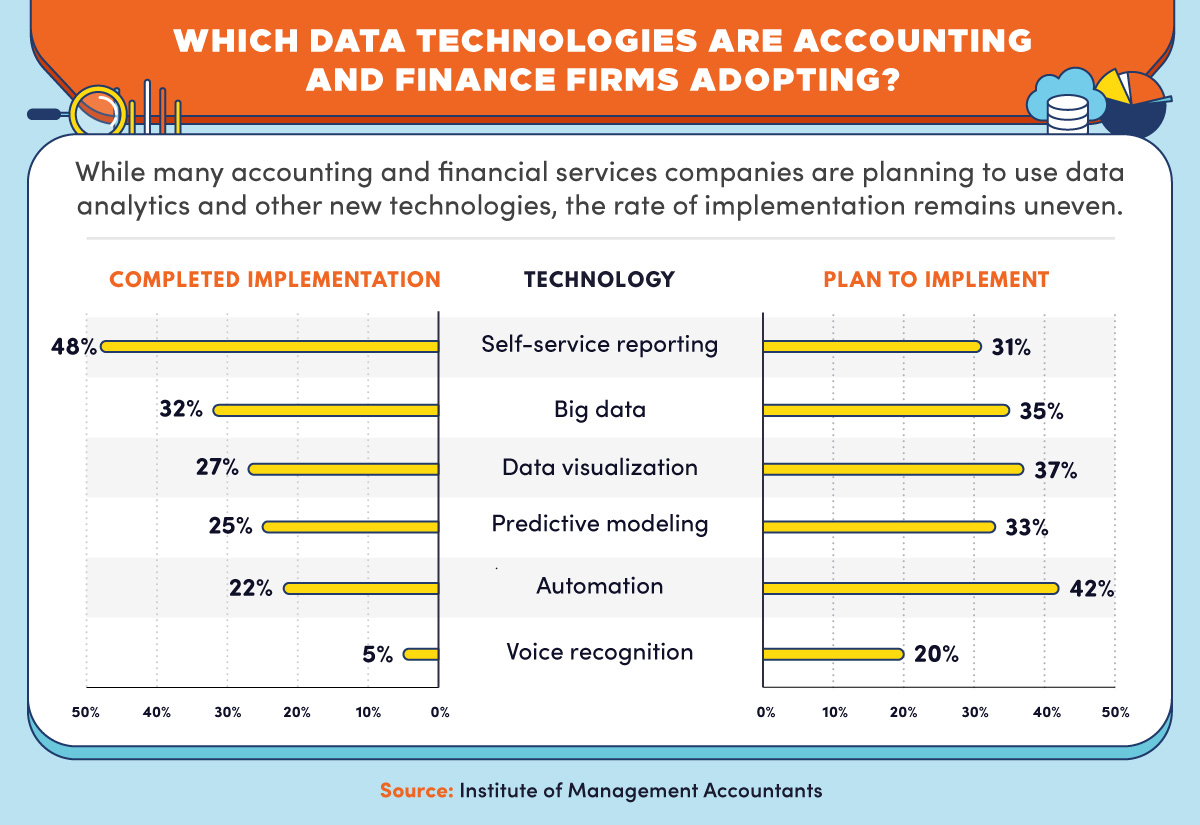

Over the past decade software platforms such as Xero Practice Manager have modernised accounting firm operations and resulted in increased storage of key business data. Today an increasing number of firms are looking at the next generation of business intelligence. Firms are exploring how data delivered in business dashboards can be used to drive growth, create operational efficiency, and support smarter decisions.

Owners have finally realised that issues which may seem initially inconsequential, may over time lead to a destitute vision and total fiasco of unfavorable business outcomes. The importance of business dashboards providing timely insights into metrics such as revenue, cost, WIP, job flow, profit, and productivity across the firm and for individual employee performance has become critical to success.

Here are 6 key points on how dashboards can supercharge your firm:

1. Obtaining timely information from Xero Practice Manager for enhanced decision making

Providing the right information, to the right people and at the right time, is critical for making the right decisions for your firm, and your clients. However, obtaining this information, at times can be overwhelming and time consuming, not to mention siloed due to a multitude of data sources that exist across the firm.

Whilst most practice management platforms like Xero Practice Manager, are equipped with a range of transactional reports, firms are now looking step up their business intelligence through operational dashboards that enhance their daily decision-making capabilities.

Business Dashboards empower your firm with real time data. This enables a better understanding of performance against metrics such as profitability, WIP, billing, debtors and creditors, productivity, and recoverability. Most importantly business dashboards provide a basis for sustained success and on-demand pivoting where required. All in just a click!

Firms are now moving away from long hours of ineffective manual reporting. Instead, an investment in real time business dashboards to run operations are creating positive business outcomes for the firms and its client alike.

2. Creating a consistent rhythm

A consistent rhythm for an accounting firm is fundamental for maintaining a controlled operating environment, delivering timely client services, and achieving profit targets. Additionally, a consistent rhythm also creates calmness, enables effective issue handling and allows for more time to be spent on strategic activities.

The most successful accounting firms have system and processes in place to ensure their operating rhythm achieves maximum profits and provides consistent cash flow. Dashboards play a critical role by allowing firms to:

- Effortlessly manage Work-In Progress,

- Manage current job load, address overdue jobs, and seamlessly plan for future jobs

- Ensuring levels of credit and debt are appropriately managed

- Streamlining routine compliance activities

- Monitor the trend of critical metrics such as productivity and recoverability

Dashboards provide real-time data which ensuring nothing ever slips through the cracks and maximum output is achieved.

3. Driving growth by providing access to KPIs for the firm, teams, and employees

All business owners understand that employees are at the core of business success. Employees can make or break a business based on their own individual performance as well as also how their influence impacts overall business performance.

Leading teams and managing employees can be very tough, regardless of the nature or size of a firm. Providing visibility across Key Performance Indicators, makes it easier to manage employees. It also allows employees to understand their own opportunities for growth and how they can become masters of their destiny.

Access to Key Performance Indicators that include productivity, recoverability, billing, WIP, billing rates, profitability, timesheets, and job completion rates are critical for employee performance and firm success.

Dashboards provide insights into these Key Performance Indicators for individual employees, but importantly roll up to a team and firm. Remember the formula “the sum of all employee performance equals overall business performance”.

Dashboards assist managers, and teams, to understand what is most important and bring their A game.

4. Effectively managing a mobile workforce operating under a hybrid work model

Current workforce trends combined with globalisation have made it necessary for employers to invest in infrastructure and processes that support hybrid work arrangements. Previously work from home opportunities were provided to staff sparingly however today this has become a global expectation. Employers that have embraced the growing trend of hybrid work models and geared up accordingly have been able to flourish. However those than have failed to evolve have experienced significant strain.

The evolution of hybrid work models whilst creating some challenges have also introduced new opportunities for businesses seeking talent. Geographic barriers have lessened, and the number of remote and offshore staffing arrangements increased whether through direct engagement or BPO.

However, to benefit from these opportunities, it is paramount for employers to manage the daily activities and performance of remote staff. Employers must have systems and technologies in place that instil trust between the employer and employee. This should be achievable without the need for continuous and exhausting management intervention.

Dashboards help reduce anxiety by providing insights into employee activity and performance based on data as opposed to subjective opinion. Most importantly is that insights are accessible anywhere, anytime and from any device.

Having visibility on data that we can rely on, will not just make it easier to manage our remote staff, but it will make our business operate more effectively.

5. Empowering self-management by providing staff focused views and performance targets

Wouldn’t it be nice to have a business where employees had the tools to self-manage, identify their own growth opportunities, have full control over their own performance and understand exactly how their individual efforts impact the outcomes of the firm?

When employees can self-manage, employers can then focus on strategic activities and urgent issues whilst having the peace of mind that the businesses operating rhythm and outputs are functioning as expected.

Dashboards equip employees with:

- An easier to manage their jobs and tasks

- A better understand of their performance and how this relates to firm expectations and targets

- The information required to ensure a high level of performance is maintained or when issues are identified providing employees the insights and tools to pivot

- Insights into opportunities that promote professional growth

It’s not just explaining expectations, it is also about how employers can enable employees to exceed those expectations.

6. Insights that find you! Automate Reporting of Xero Practice Manager Data

Imagine a world where you’re able to automatically receive the most important information for your business, on your schedule, right when you need it most.

Whilst business is complex ultimate success is determined by how well your firm responds to opportunities and threats. The quicker you are able to respond, typically the better the outcome.

At Dashboard Insights we place right information in the hands of the right people and at the right time to ensure threats are appropriately managed, and opportunities are seized and maximised.